Key points:

- Yum China is China’s largest restaurant company, projected to open an average of two new stores a day during 2019.

- KFC has 185 million reward members, while Pizza Hut has more than 60 million members.

- 90% of payments are digital.

- KFC China adapts its menu for Chinese tastes with items such as crayfish burgers and egg tarts. Likewise, only 30% of Pizza Hut sales are pizza.

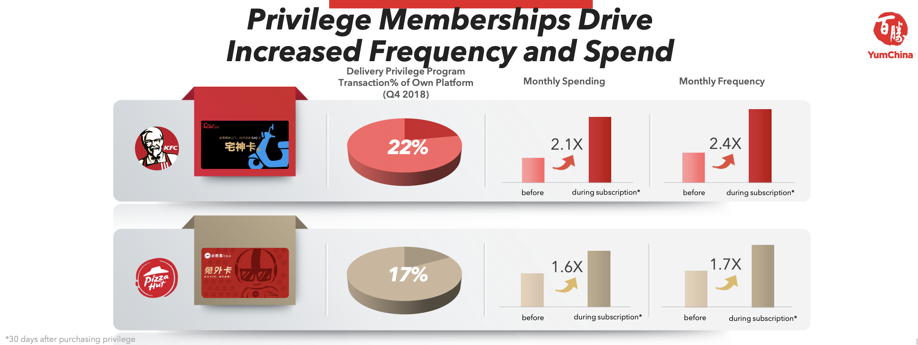

- There’s an unlimited delivery subscription plan; for US$2.50 a month, you’re eligible for free delivery up to twice a day. Delivery is 20% of sales.

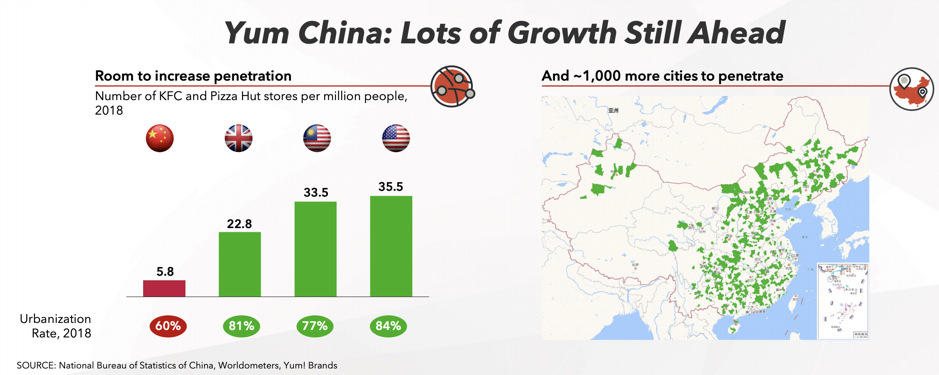

- Growth is on the menu. China has 5.8 KFC and Pizza Hut stores per million people. The US has 35.5.

- KFC’s cash payback on a new store is two years.

Yum China is the largest restaurant company in China, so dominant that it has more stores than the next two biggest players combined. Yum China owns the exclusive rights for KFC, Pizza Hut and Taco Bell in China. Yum China also fully owns East Dawning, Little Sheep and COFFii & JOY.

Data serving up better food choices

Yum China has a remarkable database of 245 million members combined for KFC and Pizza Hut. This database is a large competitive advantage or moat; it allows for cross promotion and the ability to personalise offers. As you can see, personalisation isn’t just for Netflix or YouTube; it also works for fast food menus. Each member receives a tailored pop-up menu, and 10% of customers accept their extra order recommendations, which increases sales. These members account for 54% of all sales.

Delivery all you can order

It has happened: KFC China has a delivery subscription service. KFC launched a prepaid US$2.50 membership program that allows customers two free deliveries every day for 30 days. Unsurprisingly, frequency of spend more than doubled after launch. In the second quarter of 2019, there were 4 million memberships, up triple from the previous quarter.

Growth and petrol stations on the menu

Yum China has 5,696 KFC stores and 2,209 Pizza Hut stores (as at June 2018). Yet they can still grow; recently, they announced a deal with two large Chinese oil firms CNPC and Sinopec, which collectively operate more than 50,000 gas stations across the country. It’s a strategic agreement with the modest aim to open 100 stores in the next three years. On a population adjusted basis, Yum China’s KFC and Pizza Hut store count is low.

Stores are finger-licking good; they don’t need to franchise

Franchising is a common business model for fast food chains, but not for KFC in China. They can build/outfit a store for a two-year cash payback. Yum China owns the store, and in two years, they generally receive their money back. Because the returns are so good, franchising makes up only 10% of stores. If Yum China decide to franchise, it will substantially increase its cash flows, no longer needing the cash to invest in stores. They are considering whether to franchise or own stores under the petrol station deal.

A yum for China

Yum China was previously part of Yum Brands. China is such an important market that the company was spun out to focus 100% on the opportunity. Decisions by executives in Louisville, Kentucky (Yum Brand’s HQ) couldn’t be as fast or effective as a China-focused Yum China board and investors such as Alibaba’s Ant Financial. The US-China trade war is a lesser issue now Yum China is its own separate company.

Pizza Hut does not sell pizza; is that a problem?

The problem child is Pizza Hut. Pizza Hut has had multiple branding and menu changes. Interestingly, pizza accounts for only 30% of Pizza Hut’s sales, which suggests a problem. They recently streamlined the menu, resulting in 35% less items overall, but 75% items that were either new or upgraded. There have been so many menu iterations and so little pizza that we fear customers are either put off or confused by the brand.

Any indigestion problems or risks?

Pizza Hut’s business model is also being impacted by third-party delivery services. Pizza Hut in China is a family casual dining chain rather than a delivery model. The launch of delivery services in China has increased competition with more affordable choices for families.

Fried or grilled?

Yum China’s stores are also not the healthiest options. With that said, more than half of KFC products are from the oven and not from the fryer. They also sell more traditional food such as congee, rice rolls, and mooncakes. It’s different to what we are used to at KFC Australia. If you’re into health, the app will show soup or corn, rather than fries or ice-cream. Another issue for the group is chicken, which is 40% of the cost of sales. Not much you can do about that, but we’re sure there will be a plant-based version soon!

Would you like growth and moats with a side of options?

Yum China is not your usual Western food company; their current brands have plenty of growth. There is also optionality in coffee and Taco Bell. In 2018, Yum China sold more than 90 million cups of ground coffee. In China, annual coffee consumption per capita is only 1% of the US and South Korea combined. Amazingly only 16% of consumption is freshly ground coffee; consumption is dominated by instant coffee. (No wonder coffee drinking isn’t that popular!) Taco Bell is also a future opportunity with only four stores as at August 2019. We’re not banking on these opportunities, but they have optionality; it will be interesting to see if burritos, tacos and coffee take off.

Staying hungry for Yum China

When it comes to fast food in China, Yum China is a clear leader in terms of scale, the size of their member database, and branding. They have a considerable number of competitive advantages or moats against competitors. We believe Yum Brands spinning off Yum China was key, as it unlocked local talent and investors and produced results tailored for the China market.

We’re staying hungry for Yum China.

The Spaceship Universe Portfolio currently invests in Yum China.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.