There’s a famous statue of a charging bull near the New York Stock Exchange.

Bulls represent the good times.

Investors are 'bullish' when they think an investment is going to rise in value. They might hold onto or buy more shares.

Then the bears come in.

Investors are 'bearish' when they have a pessimistic view of an investment. They might hold onto or sell their shares instead of buying more.

The stock market is often depicted as a battle between the bears and the bulls.

Generally, if there are more bulls than bears in the market, stock prices rise, and some people call it a bull market.

But if there are more bears than bulls in the market, prices tend to swing the other way.

What’s a bear market?

A bear market happens when a market falls more than 20% from its most recent high.

During a bear market, many investors lose confidence and sell their stocks, which can cause the value of companies to decline further.

Companies make less money during challenging economic periods, and look to cut costs which often results in people losing their jobs.

People have less money to spend, so they hold onto it instead of investing.

Eventually, conditions improve and whatever caused the bear market gets resolved, and the market turns around again.

It’s important to keep in mind that bear markets are an expected part of investing.

What causes a bear market?

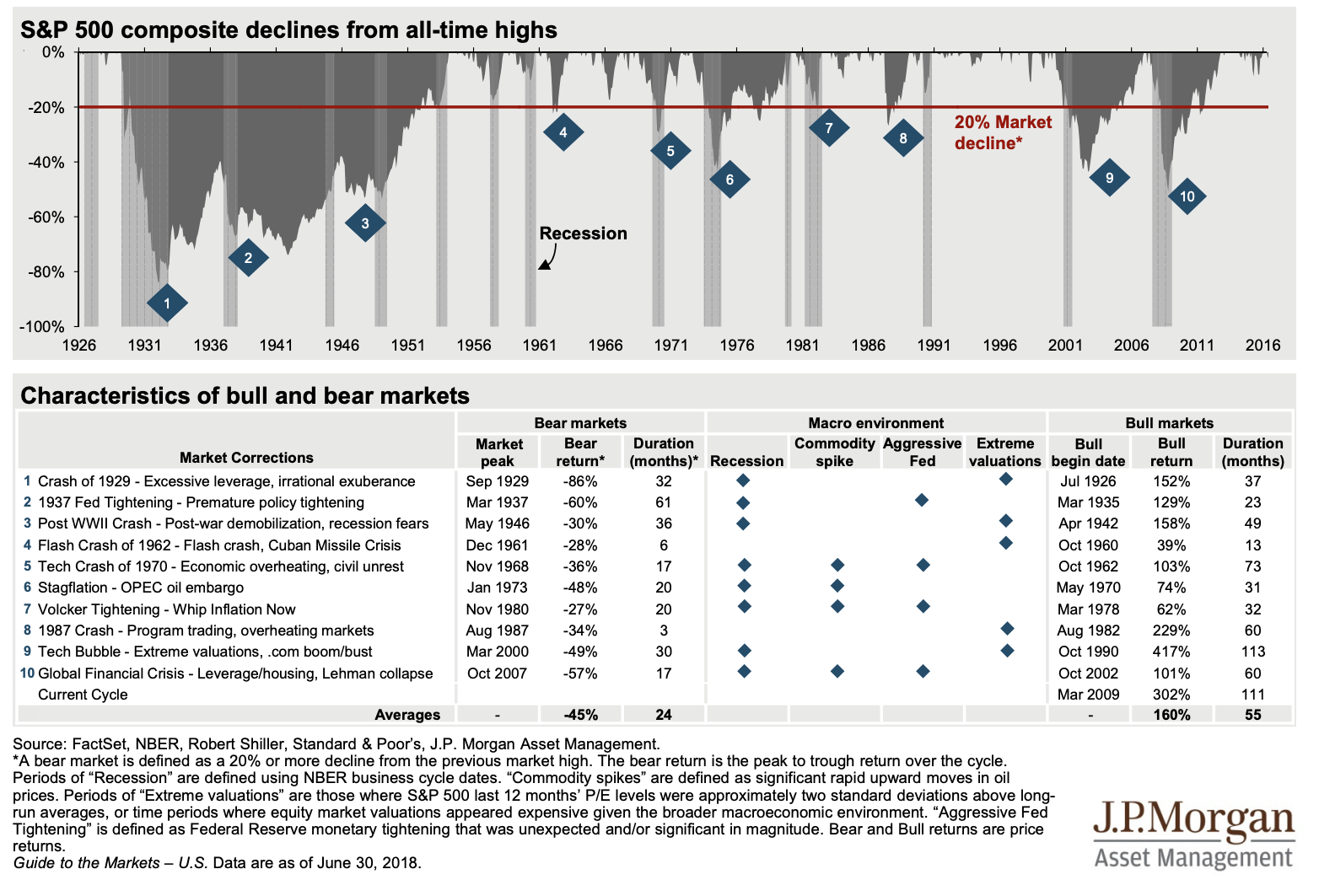

JP Morgan research identified four main causes of bear markets.

Each recession between 1929 and 2020 has at least one of the following as a cause, as shown in the following image from JP Morgan.

1. Recession fears

A recession is generally understood as a downturn in economic activity for at least two quarters in a row.

During a recession, production, spending, and employment all tend to fall. People lose their jobs and companies go under.

Recessions are generally pretty rare – there were five in the U.S. between 1980 and 2020. In 2020, Australia experienced its first recession since 1991.

Recessions can lead to bear markets because there’s generally less money available to invest. People hold onto it instead because it feels like a safer option; and companies may have less to spend to invest in their own growth, or stay afloat.

2. A commodity price spike

A commodity is a raw material that’s used to make a physical good. Commodities include oil, natural resources, and agricultural products.

JP Morgan specifically calls out oil price spikes as being something that can kick off a bear market.

When prices spike it becomes more expensive to make and sell products. The same amount of money buys less than it did before. This generally leads to businesses increasing prices, cutting costs, or doing both.

Generally, investors like investing in companies that meet or beat their expectations for things like revenue and profit. If increased costs lead to lower than expected profit, for example, this can spook investors and lead to sell offs and eventually bear markets.

3. Aggressive rate rises

Generally, interest rate rises have a negative impact on company growth and revenue, which can impact growth forecasts and make them less attractive to investors, and this can lead to bear markets.

Central banks such as the Reserve Bank of Australia or the Federal Reserve in the USA can raise interest rates if they think that the prices of goods and services are rising too quickly.

This is because they want to slow down consumer and business spending. The idea is that if people and companies have less money to spend, they’ll buy less, which will slow price growth.

When prices rise, it’s known as inflation.

Individual central banks have an inflation target. Australia’s is 2 to 3 per cent. As at July 2022, inflation in Australia was over 6%. The RBA has raised rates five months in a row, forecasting it to reach 7.75% by the end of 2022.

4. Extreme valuations

JP Morgan calls valuations ‘extreme’ if:

- In the last 12 months, the S&P 500 Price to Earnings levels are two standard deviations above its long-term averages, or

- They don’t make sense against macroeconomic environments.

This is finance speak for when the price of companies is suddenly a lot more expensive than its underlying earnings or economy hints that it should be.

Sometimes this gets called a bubble.

When people think stocks are overvalued this can lead to a correction.

A correction is generally called when a market falls between 10% and 20% from its most recent peak.

It’s common for there to be confusion between corrections and bear markets, because you have to go through a correction to get to a bear market.

How long do bear markets last?

The length of a bear market generally depends on what caused it and how quickly those things are resolved.

Let’s look at the US stock market as it’s the largest in the world.

The S&P 500 lists the 500 largest publicly traded companies in the US.

The average S&P 500 bear market has lasted 289 days, according to Ned David Research. That’s a bit under 10 months.

The same research revealed that the longest S&P 500 bear market lasted 630 days, or just under 21 months, in 1973-74, while the shortest lasted 33 days, in 2020.

What’s a bear market rally?

Bear markets are tricky for investors because they don’t know how long they’ll last, and there’s no single sign that they’re over.

Sometimes, prices can have a short-term rebound in what’s known as a bear market rally.

During a bear market rally, prices appear to stop falling and rebound for a short while, sometimes by as much as 20%, before resuming their downward trend.

This is why it’s important to remember that nobody can predict what the market’s going to do. What looks like the end of a bear market may just be a rally, and vice versa.

How do you know when a bear market is over?

There’s no single sign that a bear market has finished.

Generally, at the bottom of the market, stock prices stop making big movements up or down and trend sideways.

There can be other indicators.

These may include a market trending upward, reaching higher lows over time; there may be an increase in the volume of stocks being bought, showing more people are confident about investing; and a market may react positively to news that would usually be seen as bad, showing that the bad news has been ‘priced in’.

The bottom of a bear market is something investors can only tell with hindsight.

The most important thing to remember is bear markets always end and, if you’re a long-term investor, it can pay to keep dollar-cost averaging through it, if you understand what you’re investing in and it works for your personal circumstances.

What happens at the end of a bear market?

Historically, bear markets have always been followed by all time highs at some point. We can’t predict the future but that’s a pretty strong case for it happening again.

From 2001 to 2021, most of the S&P 500’s best days happened during bear markets, according to Ned Davis Research, which is why it can pay to stay invested.

At Spaceship we’re long-term investors and while we know that bear markets are painful, we also know they’re to be expected. This is why we recommend a minimum timeframe of 7 years for all our Spaceship Voyager portfolios.