Whether you’re a new investor or a seasoned pro, investing money is all about saving for the future. But what returns should fellow Spaceshippers expect and plan for?

Let’s start with one of the best. Warren Buffett, one of the greatest investors in the world, has compounded his wealth at 20.0% per annum since 1965. It doesn’t sound like much but over time compounding produces astounding results, Buffet is now one of the richest men in the world. Although expecting a similar investment outcome is not a great idea (because investing is subject to risk - markets can rise and fall and investment returns could be zero or negative), it helps to set expectations of what investing may achieve.

“No one wants to get rich slow”

There are many great Buffet quotes but one of my favourites is a discussion with another favourite billionaire of ours, Amazon’s Jeff Bezos. Bezos: “[I asked Warren] your investment thesis is so simple. You’re the second richest guy in the world and it's so simple. Why doesn’t everyone just copy you?”

Buffet: “Because nobody wants to get rich slow”.

In an era of instant gratification, it’s important to remember that saving and investing takes time.

Back in my day

From 1900 to 2020 global stock markets produced a 5.3% per annum real return (performance after inflation). So, the average return including inflation is a mid to high single digit percentage. In the same period the US stock market had a real return (after inflation) of 6.6% per annum. So perhaps, expecting these kinds of returns is a reasonable expectation. But as you know past performance is not a reliable indicator of future performance so your actual returns may be better or worse.

Is there anything else? Superstocks.

While the average return after inflation in the US for the period between 1990 and 2020 was 6.6% per annum, it's volatile (that is, risky).

Some of the volatility exists because the stock market is sometimes a bit like a hits-driven business - like venture capital, or book and music sales, there are a few big winners. Companies tend to have life cycles like people - some are growing, some stable and some are in decline, and only a few are really hitting it out of the park.

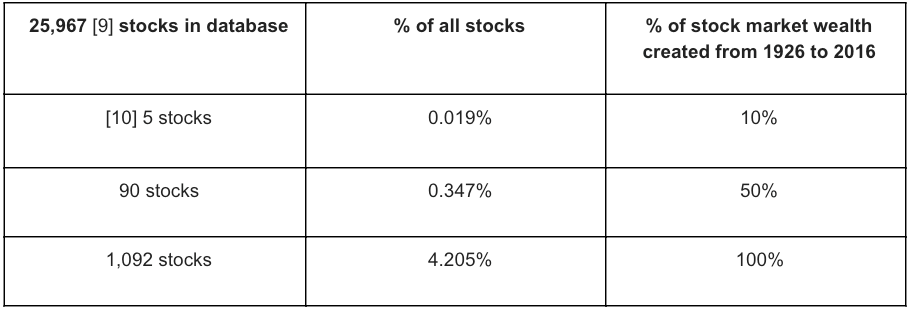

A study by US Professor Bessembinder exploring whether US common stocks outperform treasury bills over the period 1926 to 2016 found that most stocks aren’t good investments as compared to treasury bills. In fact, the Professor Bessembinder's report found that the majority of listed common stock didn't beat returns on cash, and that most common stocks result is a loss. A small % of stocks make up the majority of returns.

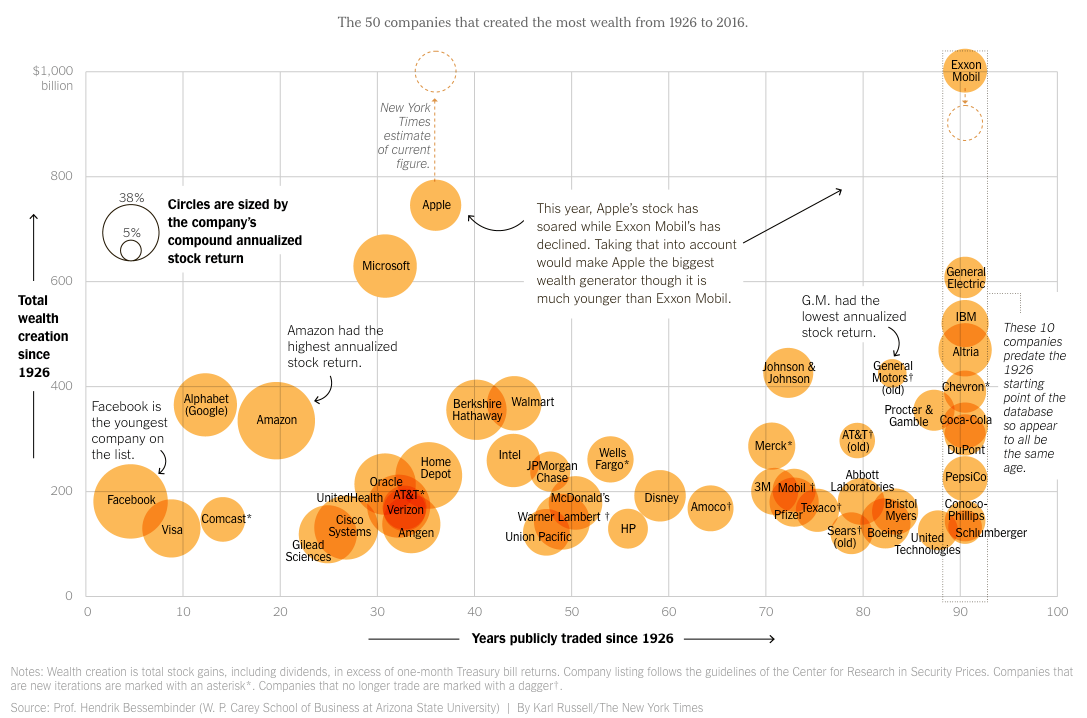

So, like venture capital, it seems that investing in the stock market is positively skewed, it's the superstocks that pull up the average return of the market. The report details that slightly more than 4% of all publicly traded stocks accounted for all the wealth earned by investors in the stock market over the period 1926 to 2016 (have a look at the table below for some additional details). Just 36 stocks were listed for the full 90 years.

It’s possible that stock market returns will be even more concentrated in the future as the internet and globalisation creates dominant winner-takes-all companies who benefit from network effects. An example being the FANGs (Facebook, Amazon, Netflix, Google), as their businesses grow they become more useful to customers.

Volatility

So, finding great companies is the answer? The problem is, great investments are rare and hard to find. Even if we are able find a potential superstock, we should expect high volatility. The share price of Amazon, one of the newer companies included in the above graph has fallen at least 20% from its highest share price (peak) to its share lowest price (trough) in 17 of its 22 years on the public market. It’s a great investment but it took tremendous discipline or blind faith to hold on during the falls (as shown below).

Source Amazon’s IPO at 20: That Amazing Return You Didn’t Earn, The Wall Street Journal, 14 May 2017

The only guarantee for investors?

Time and volatility. Now we know what we’re up against. It takes time to build wealth. It’s a reason we started Spaceship Voyager, we want to make it easier for investors to get started investing and help them to understand that building wealth takes time. We just have to start. Once we better understand expected returns we can better plan, it also usually means we have to get started!

It's also hard to find the great companies and can be hard to hold on. That’s why a diversified portfolio can work - a diversified portfolio helps you to reduce risk by ensuring that all your eggs are not in the one basket. And, if stocks in a portfolio are well picked - it could increase the chance you have exposure to potential superstocks. That’s why we created Spaceship Voyager; each of the funds provide investors with a diversified portfolio.