It’s been an interesting three years, particularly the last year, in part because the companies we invest in are good at solving problems.

Problem-solving increased during COVID-19 as companies needed to reach customers during lockdowns. This accelerated the digitalisation of the economy, which means that companies found new ways to take more of their products and services online.

Crises and corrections are bad for markets, but volatile environments aren’t necessarily bad for forward-looking companies. A crisis can increase the pace of innovation, openness to change and build new habits. This can create an opportunity for companies to influence consumers – who are normally creatures of comfort – to become more open to change.

Where the World is Going

At Spaceship, we invest using our Where the World is Going (WWG) methodology. This means we’re focused on companies with products and services that we believe have potential growth and a competitive advantage, and will become more relevant over time.

Long story short, we ask ourselves some key questions like:

- Is a new trend or habit being built. Does the company have a service that’s becoming more relevant or is it a better problem solver?

- Does it have a moat. Does the company have a competitive advantage such as scale, branding or a networking effect?

- Management. Does the company’s management act like long-term owners would?

- Expected returns. Could the company double in value over the next five years?

The history of the Spaceship Universe Portfolio

Over the three year lifespan of the portfolio, we've experienced three portfolio corrections, which is defined by a fall of more than 10%.

When markets are volatile (i.e. they’re unpredictable and experiencing big changes), the most common question we get asked is what are we doing in relation to specific risks? Over the years, concerns have included COVID-19, lockdowns, inflation, value stock rallies, etc.

HODL: Holding On for Dear Life

Some have suggested that doing nothing and holding doesn’t seem smart. Shouldn’t we be trading and reacting given inflation concerns?

Interestingly, this is the one question we never get asked: what is our holding discipline and do we follow our processes?

The WWG methodology is focused on longer term structural trends, solving problems and new habits, not cyclical short term economic trends.

If we don’t follow our process, we run the risk of selling a great company for a short-term reason or reaction.

The ability to hold onto outperforming stocks has been a large contributor to outperformance but also a contributor to short term volatility.

Trust the process

Holding onto great companies can be difficult given there can be many short term reasons to sell. Hendrik Bessembinder’s studies have been influential in our longer term thinking, highlighting the positive skew in the stock market and concentration in returns.

It’s much like venture capital investing where a small number of companies generate most of the returns. The traditional 80/20 pareto power law is more like 99/1 in global stock markets. Bessembinder’s studies revealed that 1.3% of global stocks created 100% of stock market wealth.

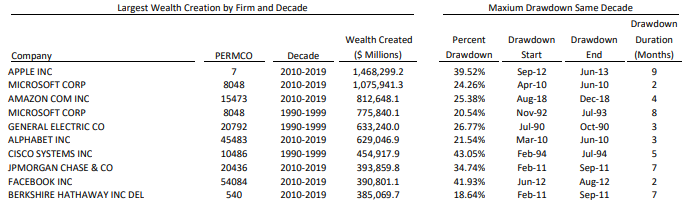

In another study Bessembinder focused on stock drawdowns, highlighting even the best performing stocks are volatile. As above, Apple corrected 39.5% over a 9 month period. The best wealth creators experienced drawdowns that lasted on average 10 months and an average loss of 32.5%. Bessembinder’s study covered 62,000 global stocks over 1990-2019.

Top performers

As we look back over the past three years, it’s important to ask what have we learnt?

To start, we’ve seen our top performers more than make up for our mistakes. Our top five positions contributed to the portfolio 4.6 times greater than the top five negative detractors.

Our WWG methodology focused on companies building products and services becoming more relevant over time, leading us to invest in some of the best performing stocks.

These are our largest portfolio contributors by order as at 7 May 2021:

1. Tesla: Up 1039%

Tesla’s mission is to accelerate the world’s transition to sustainable energy, helping solve the problem of climate change. As at February 2021, Tesla’s brand, vertical integration of hardware and software, battery production scale and storage made it the leading global electric vehicle company. It has led to increasing adoption of electric vehicles and renewables.

2. Shopify: Up 533%

Shopify helps people achieve independence by providing a global e-commerce operating system (website, shipping and payments), making it easier to start, run and grow a business.

Unlike most e-commerce companies Shopify is focused on merchant sellers not consumers, powering more than 1.7m merchants with over 6,600 third party apps as at April 2021. Shopify is the second largest e-commerce company in America, as at October 2020.

3. Sea: Up 515%

Sea’s mission is to better the lives of consumers and small businesses with technology. Operating in south-east Asia, Sea owns multiple brands and businesses. Sea is the owner of Garena games, famous for Free Fire, the most downloaded mobile game worldwide in 2019 and 2020. Sea has reinvested its Garena cash flows to help its e-commerce division Shopee and SeaMoney payments become leading businesses in south-east Asia, according to App Annie.

4. Square: Up 270%

Square builds tools to empower and enrich everyone, with a goal to enhance economic empowerment for all. In Australia we’re most familiar with their point-of-sale system for merchants. Australia is Square’s largest international market, highlighting the potential for international expansion.

Recent growth has come from a consumer service not offered here, the Cash App. This app allows anyone to send, spend and save money all from one app, and in December 2020 it had more than 36 million monthly active customers. Square’s strong position with businesses (through point-of-sale) and now consumers (through the Cash App) hints at a potential new financial network connecting both sides of a transaction.

5. Mercado Libre: Up 370%

Mercado Libre’s mission is to democratise e-commerce, generating economic inclusion in Latin America. Mercado Libre means free market in Spanish. It hosts the largest online commerce and payments ecosystem in Latin America with 132.5 million unique active users in 2020 and US$21 billion in sales. Mercadolibre has leveraged its strong e-commerce position to build MercadoPago into a leading payments platform.

Lessons learnt

The biggest lessons come from mistakes. We’ve had detractors over the period such as Baidu, Boeing, and Freedom Foods. The lessons? Be extremely wary of poor cash flow and debt levels. We’ve always been careful and have become even more so. The overall portfolio is net cash i.e. the companies in our Spaceship Universe Portfolio have cash balances that are more than their debt.

We believe our biggest mistakes have been sins of omission, not sins of commission.

Sins of commission are observable: the investment detracts from the portfolio.

But sins of omission – i.e. stocks we didn’t buy that have increased multiple times – are much more costly than a stock falling 25%, as an example. You can’t attribute sins of omission to portfolio returns but they can be the largest mistakes we can make in terms of our wealth.

For example, we have missed investing in Pinduoduo, a Chinese e-commerce company that pioneered collective buying. The more buyers in your social buying pool, the larger the discount you receive on goods.

Another example is Zoom; their video conferencing service was a lockdown beneficiary. Both meet our definition of products and services becoming more relevant over time but we were uncertain over the strength of the moat or competitive advantage, and we’ve so far been proven wrong.

We won’t be able to invest in every disruptive outperformer but we will do our best to look for and assess them according to our WWG methodology.

Change is occurring faster than ever, creating more investment opportunities for the Spaceship Universe Portfolio. We’re focused on the sustainability of habits brought on by change and the tools and services needed going forward.

Thank you for supporting us and investing in where the world is going.

The Spaceship Universe Portfolio invests in Tesla, Shopify, Sea, Square and Mercado Libre at the time of writing.

The Spaceship Origin Portfolio invests in Tesla and Shopify at the time of writing.

The Spaceship Earth Portfolio invests in Shopify, Square and Mercado Libre at the time of writing.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.