Spotify: The stairway to heaven is audio

Spotify is synonymous with music streaming. That happens when you have 207 million monthly active users, in 79 countries, with access to more than 40 million tracks.

Not happy to rest on its laurels, Spotify plans to be the world’s leading audio platform (it’s not just music!) with a targeted 20% of listening coming from non-music i.e. podcasts. It’s an important distinction, as podcast economics are different to music streaming, reducing a key investment concern for us at Spaceship.

The sound of music?

The economics of music streaming are difficult. For every dollar Spotify receives, 73 cents is paid to record labels for music royalties. As Spotify grows, its royalty payments increase inline with sales, making it hard for the business to scale. Spotify’s global streaming market share was 38% in 2017 by revenue. Spotify made up almost half of global revenues from paid streaming to record labels in 2017, according to MIDiA Research.

The stairway to heaven is audio

This is why non-music audio and podcasting are so interesting; there are no royalty payments to record labels. Additionally, podcast users are twice as engaged, reducing customer churn. Lower churn leads to a higher customer lifetime value and increases the ability for future price increases. Spotify is already the second largest podcast business in the world after entering two years ago and plans to spend US$400-$500million on multiple podcast acquisitions in 2019.

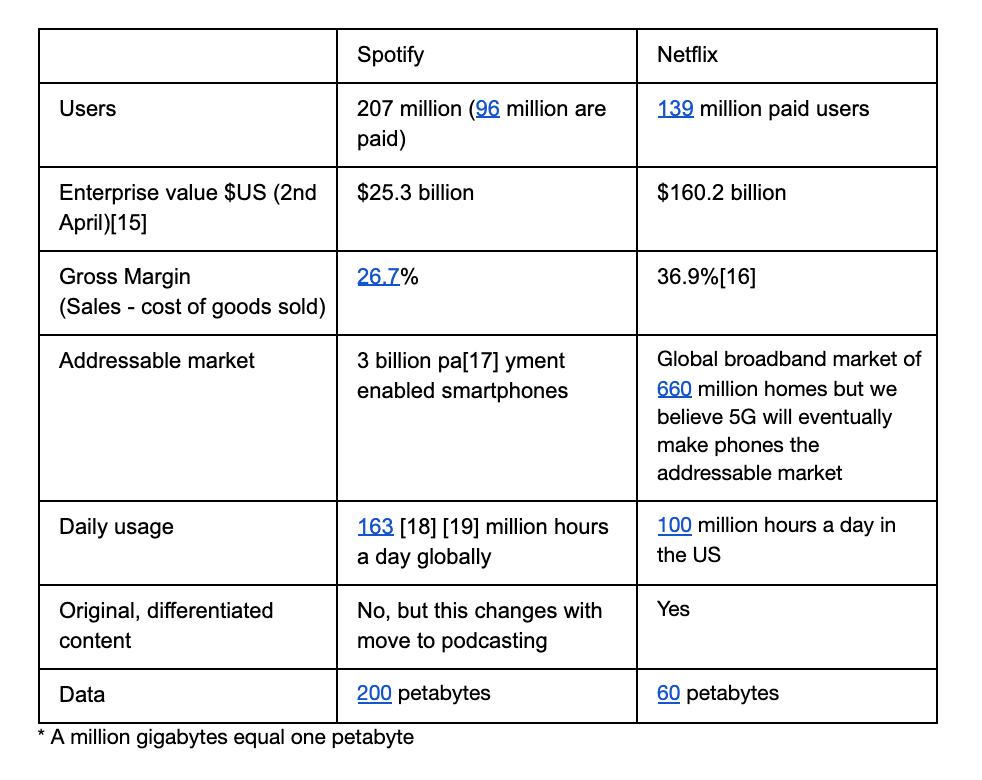

Sounds similar to Netflix but I can’t get no satisfaction

Spotify is a leader in music streaming, similar to Netflix in television, but a key difference is music royalty costs. Netflix’s genius lies in producing original differentiated content that can scale, with fixed costs globally across hundreds of millions of users. Netflix originals make up only 20 per cent or so of its library, but figures from the U.S. suggest they account for a third of viewing. Spotify’s problem is that as sales increase, so do royalties to the four big music companies. In fact, 85% of Spotify’s streaming in 2018 came from Universal Music Group, Sony Music Entertainment, Warner Music and Merlin.

Heard this song before?

If Spotify were to produce its own music, like a record label, it would essentially make the four music record labels competitors. This would be a worry, especially when the record labels have leverage over Spotify with their music catalogues. Podcasting allows Spotify to produce original, differentiated content, with fixed costs that can scale (i.e. no royalties), while not upsetting the record labels. Now, Spotify starts to look more like Netflix’s business model.

Hallelujah (to the moat)

Spotify competes based on the user experience, music discovery and personalisation.

More data equals more personalisation (and it means more recommendations will be provided to users). This discovery aspect is key; there are more than 40 million songs to choose from, with far more choices than video streaming.

This “my data is bigger than yours” data game leads to better personalisation and more usage, resulting in a positive feedback loop. It also creates a switching cost for users; they don’t want to lose their listening history to start all over again with recommendations from a new service.

Spotify programmed 31% of all listening in 2017, useful for artist marketing, with Drake being the world’s most-streamed artist in 2018 with 8.2 billion streams to his name. Finally, Spotify has a strong brand; iTunes for downloads, Spotify for streaming.

We don’t need to own the music, we just need to be able to access it.

R-E-S-P-E-C-T (competitors like the big Apple)

App stores and platforms such as Apple and Google are a major risk.

They not only run app stores that collect a 30% toll, but also compete with Spotify with their own music apps. It’s hard for Spotify when competitors don’t have to make money on the product.

That said Spotify’s focus is its advantage; its service works on all phone app platforms.

Spotify is also hardware agnostic, teaming up with other companies such as Samsung to increase distribution of its product.

What’s going on? Ads are good

Some investors might not like the free advertising supported version.

But we do; it’s a marketing trial for new users. Ad-supported Spotify decreases user sign-up friction and builds data over time around listening habits, leading to better recommendations and a more useful service. What’s interesting is that approximately 50% of monthly active users become subscribers within 36 months.

It’s a cost effective way to acquire subscribers and they also earn some advertising revenue, even though it’s “free”.

Bridge over troubled water

Video is a trillion-dollar market, while the music and radio industry is worth around a hundred billion dollars.

As the CEO says, why are ears only worth 1/10 of your eyes?

We agree, believing the music market is undervalued. The introduction of streaming has reignited the music industry, helping sales grow again, although as seen below, revenues for 2017 were just 68% of the peak in 1999.

Good vibrations

The pivot to audio and podcasting creates scale for Spotify.

We were initially skeptical Spotify could follow Netflix on a similar scale journey because of the difficulty of differentiating music catalogues and increasing royalties alongside sales.

Podcasting changes the tune. Podcasts can be original and differentiated, and as the content is owned the same way a Netflix original is, Spotify can scale with no royalties.

Spotify is a story we’re listening to, volume up and on repeat.

___

The Spaceship Universe Portfolio currently invests in Spotify.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.