Our Senior Portfolio manager shares an update about Where the World – and our Spaceship Voyager Portfolios – could be Going this year.

Thank you for your support over the past year.

2022’s macroeconomic environment and portfolio performance has been challenging and the news headlines have been hard to read.

It’s a difficult environment to stay invested in for the long term so we are grateful for your long term investment time horizon and support.

While the headlines continue to be horrible, it’s important to remember to invest through headlines, as headlines don’t last but great businesses do.

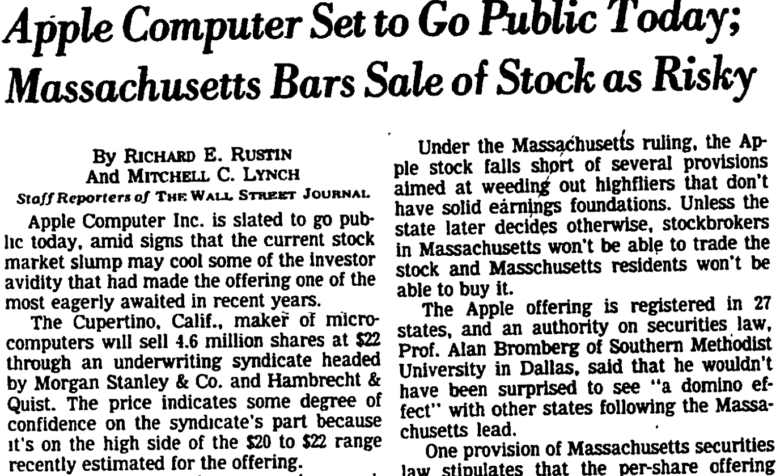

At Spaceship, one of our favourite news headlines is a Wall Street Journal article covering Apple’s IPO in 1980.

Source: WSJ

Fast forward to today and the headlines announce Apple as the largest business in the world worth over US$2 trillion as at December 2022. Yet, at the time of Apple’s IPO, individual investors from seven US states were banned from investing in Apple because it was deemed too risky. Apple is now considered an investment ‘blue chip’ and the best business in the world.

At Spaceship, we look through similar short term event headlines that are designed to catch the reader's attention, instead anticipating future business headlines.

We believe it’s just as important as it’s ever been to remain invested in yourself and your future.

Looking back

The past year has seen significant pressure on technology and growth stocks, providing short term challenges as well as what we believe are long term opportunities.

We are sifting through the current volatility to determine the long term business impacts.

Most of our recent underperformance has been from our more economically sensitive stocks, exposed to digital advertising such as Meta, which has earnings risk, but where we believe recession risks are mostly priced in.

The other underperformance has been from software stocks such as Autodesk that have less earnings risk as sales are recurring but higher valuations which make them more sensitive to higher interest rates.

Looking forward

The outlook for technology is mixed depending on who the company is selling their product to. We will add less capital to technology companies whose customers are other technology companies. These businesses typically sell software based on employee or per seat licensing. Given capital constraints and hiring freezes, we believe these companies will no longer grow as they have in the past.

Instead, we are focusing on technology companies that are providing services to industries that have less cloud adoption.

We also like companies that are exposed to growth in data usage such as Snowflake which are better placed, given the growth in data compared to softer technology hiring.

Strength in our portfolios has come from businesses exposed to the US consumer such as Starbucks and Nike.

Contrary to popular belief, the majority of US households are not facing interest rate rises next year given US fixed mortgage rates can be locked in for 30 years. According to Goldman Sachs, less than 1% of US households are facing higher interest rates on their mortgages next year compared to 60% of Australian households that unfortunately will see higher mortgage rates next year.

Portfolio characteristics

Most listed companies have, and will continue to be impacted by the difficult stock market and rising interest rates however those with a strong cash balance and minimal debt will be less so.

Thankfully, the Spaceship Universe portfolio companies are net cash meaning that the net debt to equity number is negative because cash exceeds debt (shown below). Net cash is important for companies, especially as interest rates rise. Cash increases optionality, and can be used either for expansion or investment. This is compared to companies with leverage, which means that they have more debt than equity. These companies see their costs increase, and as interest rates rise, these businesses will find it more difficult to expand their business.

While most companies are net cash, there is some exposure to businesses that are generating negative cash flows. Out of the Spaceship Universe portfolio’s 75 stocks, in 2023 we expect 8 stocks to be free cash flow negative, or by weighting 8.6% of the portfolio.

Out of the Spaceship Earth portfolio's 39 stocks, we expect 5 stocks to be free cash flow negative, or 13.4% of the portfolio.

We keep a particularly close eye on these companies and are confident that these businesses have enough cash on hand to become cash self- generating.

In 2022, we also saw an increase to the cost of energy, including oil prices. We also expect WWG companies (those that we’ve picked for our sSpaceship Universe and Spaceship Earth portfolios) to be less exposed to higher energy input costs with emissions well below the Spaceship Origin portfolio (which is a proxy for the overall stock market).

In terms of overall growth, the valuations of the three Spaceship Voyager portfolios are not significantly different but the WWG portfolios (the Spaceship Universe and Spaceship Earth portfolios) are growing faster with less debt and are less exposed to Greenhouse gas emissions.

| Portfolio characteristics | Spaceship Universe Portfolio | Spaceship Earth Portfolio | Spaceship Origin Portfolio |

|---|---|---|---|

| Enterprise value/EBITDA | 13.4 | 14.5 | 11.3 |

| Net debt to equity | -18.2% (net cash) | 14.0% | 90.0% |

| Estimated greenhouse gas CO2 emissions | 844,202 | 602,690 | 7,591,650 |

In a volatile environment, long term competitive advantages become even more important.

An example is MercadoLibre, the leading ecommerce provider in Latin America. MercadoLibre’s largest market is Brazil. Brazil has historically been more volatile than most markets due to high inflation. As of December 2022, Brazil’s interest rate is 13.75%, up from 2% in 2021. Over the same period MercadoLibre’s revenues have increased 49% and earnings have increased 230% while shares are down 38%.

Interest rates are important in the short term but over the longer term business fundamentals win out. Back in 1999 when MercadoLibre was founded, Brazilian interest rates were at a peak of 42% and have averaged 12.25% since then, yet MercadoLibre has grown from zero revenue to USD$10.5 billion over this period. Similar to MercadoLibre, other well positioned companies can also do well in tough environments, increasing market share, building moats and effectively serving and winning over customers.

While headlines may remain challenging, tough markets also provide opportunities. At Spaceship we continue to invest in Where the World is Going, investing based on future potential business headlines rather than current macroeconomic news.

Thank you again for your support.

Some of our Spaceship Voyager portfolios invest in Apple, Meta, Autodesk, Snowflake, Starbucks, Nike, and MercadoLibre at the time of writing.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.