It was a good year for global and Australian stock markets. Currency helped our Spaceship Voyager portfolios when it came to returns this year, with the fall in the Aussie dollar increasing the value of our overseas holdings. (On the flipside, currency risk could work against the portfolios in the event that the Aussie dollar increases when compared to the US dollar.) We ended the year with more than $50 million under management and 50,000 customers (and counting) across our Spaceship Voyager portfolios.

Macro in review

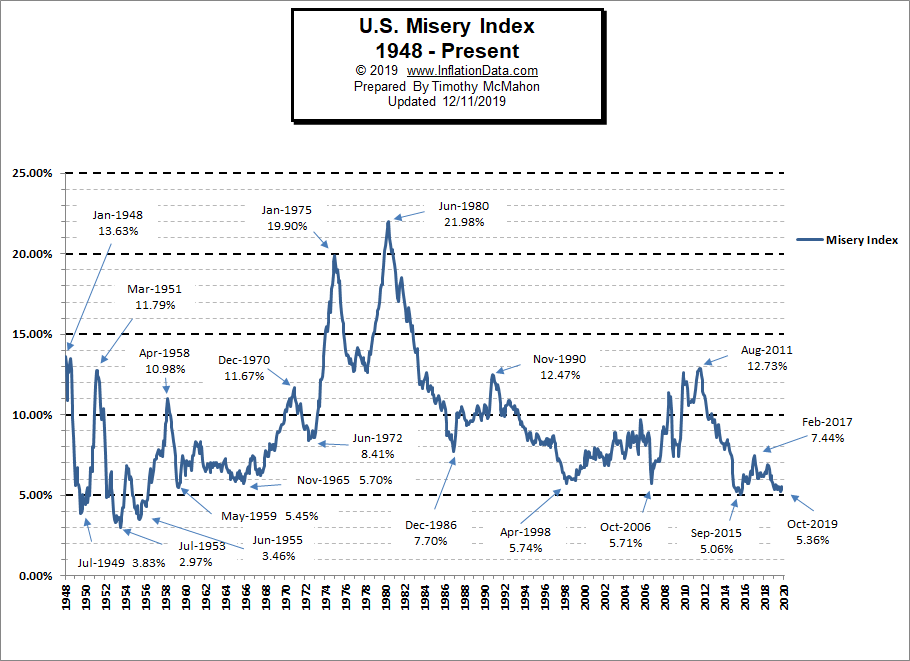

The trade war between China and the U.S. dominated news headlines. As an investor, it’s always interesting to see what is being reported in the news versus developments that aren’t. The trade war is clearly negative but what is rarely mentioned is low unemployment in the US; it’s at a 50 year low, alongside low inflation and low interest rates. The combination of inflation and unemployment indicators is measured by the very gloomy sounding “misery index” (see below). In a historical context, the U.S. economy is looking good. It’s the exact opposite of what happened in the 1970s, when the stock market was affected by high inflation and unemployment. This time there is low inflation and low unemployment helping keep interest rates low, which is a great environment for stocks.

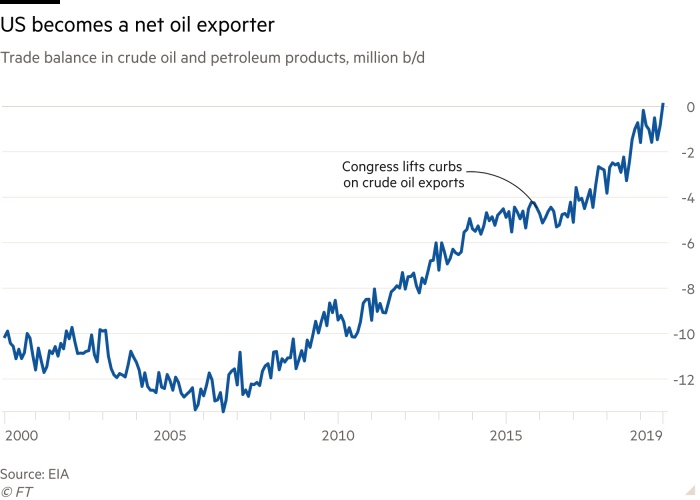

Also interesting, the U.S. became a net exporter in world oil markets. It’s the first time the U.S. sold more oil than it imported since the 1940s. It’s a global positive for geopolitics, driven by increased production for shale, natural gas output, and renewable electricity generation.

Stocks in review

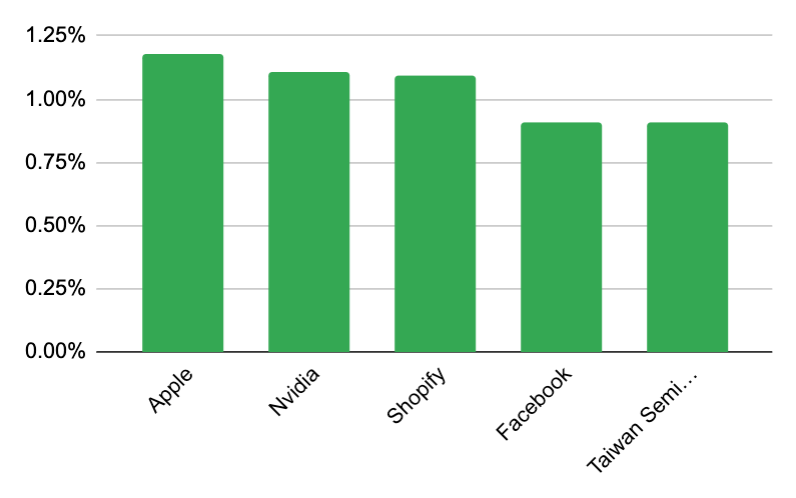

The biggest contributor to the performance of the Spaceship Universe Portfolio was the tech sector, with the largest company in the world, Apple, becoming even bigger.

Apple

Who would have thought wearables such as AirPods could be so exciting? Sales of Apple’s wearables, home products, and accessories are on track to overtake Mac sales, which last quarter were US$6.99 billion down 4.7%, while wearables were US$6.52 billion up 54% year over year. Apple shares rose as they successfully proved their ability to upsell more hardware such as Apple Watch and AirPods and services such as Apple Pay and Apple TV. This allowed Apple to make more money out of their current user base while also increasing the cost of switching/leaving the Apple ecosystem.

Nvidia

Shares rebounded after the big selloff that hit them (along with Bitcoin) last year. Nvidia chips were being used for Bitcoin mining, which resulted in increased inventory of their General Processing Units (GPU) chips as the Bitcoin price declined. We are more interested in Nvidia’s GPUs being used for gaming and data centres for artificial intelligence, which investors refocused on once inventory returned to more normal levels.

Shopify

Shopify is a platform that helps more than 1 million merchants sell online. Shares had a good year as they announced plans to add fulfillment services, allowing merchants to store and deliver products within two days with Shopify’s warehouses. Shopify has been so successful that they are on track to be the second largest U.S. ecommerce company ahead of eBay.

Facebook rebounded after a difficult 2018 due to privacy concerns. While concerns still remain, their other brands, Instagram and WhatsApp, continue to grow with both customers and advertisers. We believe that Facebook shares should trade at a higher price earnings ratio, as there are not many large companies that can grow revenue nearly 30%.

Taiwan Semi

Taiwan Semiconductor is the largest semiconductor foundry in the world, with a market share of 56%. It produces semiconductor chips for companies such as Apple and Nvidia. Shares outperformed this year, as investors looked to next year’s release of 5G phones and networks, which require more complex chips.

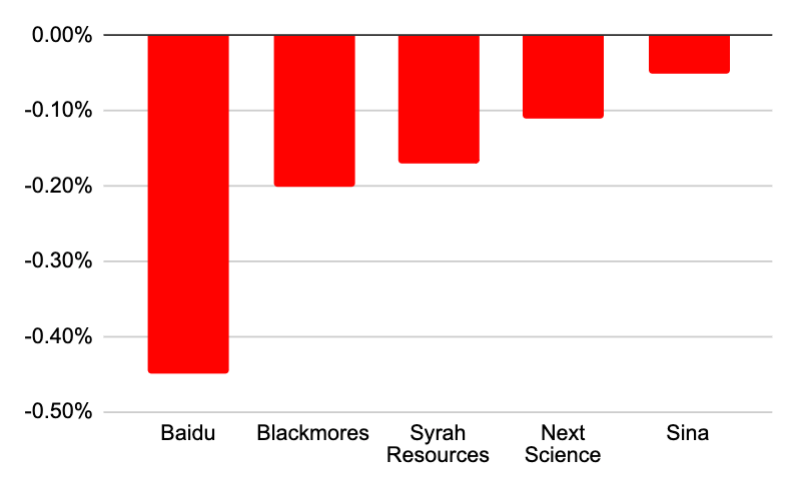

Baidu

Our worst performer was Baidu, also known as the “Chinese Google”. Baidu is the leading search engine in China but their moat is not as strong as Google due to there being stronger competitors in China. There are some cyclical trade concerns but the main reason has been the intense competition for eyeballs in China, with Tencent’s WeChat dominating app usage and new comer Tik Tok gaining more usage and views.

Blackmores

We sold the position during the year due to management turnover and concerns over their strategy in China, where they appear to be looking for a partner. Even with a partner we believe they have lost momentum in China, which is becoming a more competitive market.

Syrah Resources

We sold out during the year as graphite commodity prices fell faster than expected with management making the decision to decrease mine production. We lost confidence in management’s ability to execute and sold out of the position.

Next Science

Shares fell as partner sales materialised slower than expected. 3M (a partner) in particular was distracted by an acquisition. Their major partnerships are still in place, so we believe this is more of a delay in sales rather than an issue.

Sina

Similar to Baidu, Sina’s investment in Weibo, also known as the “Chinese Twitter,” suffered from the trade war and competition for eyeballs from WeChat and TikTok.

Our outlook

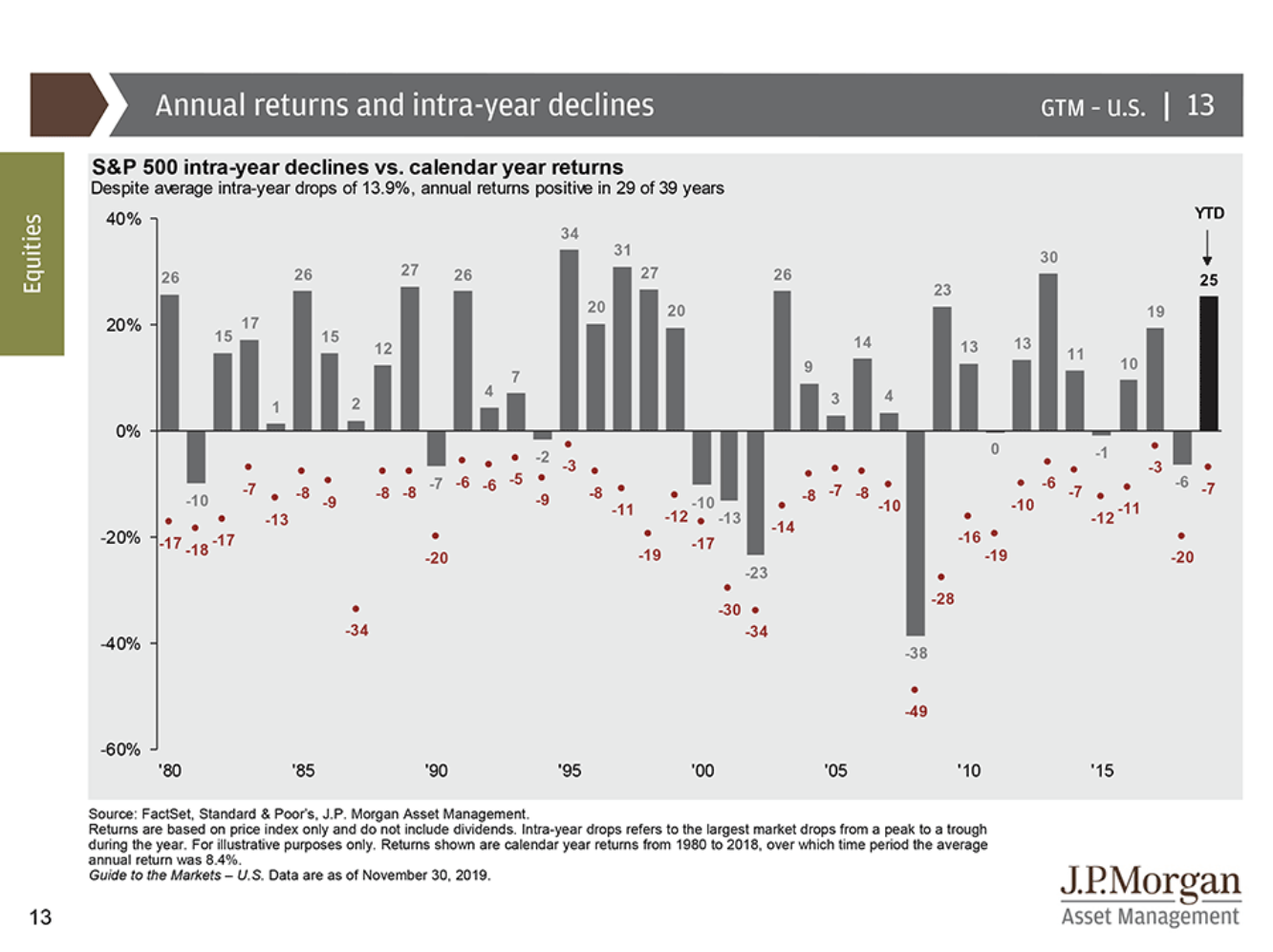

It’s always difficult to predict the stock market. The old saying is stock market forecasters are there to make astrologers look good. Hindsight is 2020! (Sorry, we had to put that one in for next year.) All we know is that the market will be volatile and it’s very hard to time, especially when you take the tax consequences of frequent buying and selling into account. The market was historically calm this year, with the S&P500 seeing an intra-year drop of 7%, which is well below the average intra-year drop of 13.9% over the last 39 years (see below), while also achieving higher than average returns.

No matter the outlook, we believe in investing where the world is going. We believe in investing in companies that seem to be benefitting from future trends with competitive advantages or moats to keep out competition.

Thanks for your trust.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.

The Spaceship Universe Portfolio invests in Apple, Nvidia, Shopify, Facebook, Taiwan Semiconductor, Baidu, Next Science, and Sina at the time of writing.

The Spaceship Index Portfolio invests in Apple, Nvidia, Facebook, and Taiwan Semiconductor at the time of writing.