If you're investing for the long-term it could make sense to set up a regular investment plan.

Here are five reasons why you might.

1. You stay focused on where you’re heading

If you're a Spaceship Voyager investor, you’ll want to give your money enough time to grow through market highs and lows – we recommend at least seven years.

Automating your investing makes it easier to filter out the short-term market noise in the meantime.

2. You can dollar-cost average through a downturn

Investing the same amount of money regularly helps you smooth out your average purchase price so you don’t end up making all your investments at their highs. It’s called dollar-cost averaging.

3. You can stop wondering when the right time to invest is

Timing the market’s impossible, and by trying to miss the biggest falls, you’re more likely to miss the biggest rises.

4. It makes investing a habit, not a hobby

If investing is part of your budget, you don’t have to stretch to find extra money.

5. Investing through a bear market sets you up to take full advantage of a bull market

Tough market conditions are a normal part of investing. If you buy stocks at their lows, you can benefit from the growth their highs deliver.

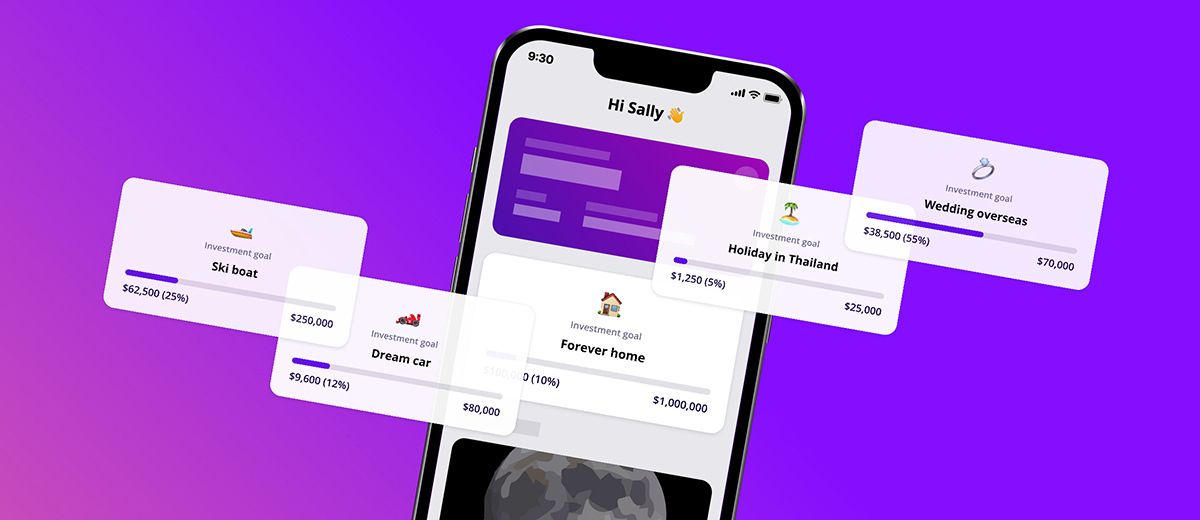

🚀 Spaceship Voyager investor?

You can automate your Spaceship Voyager investing by setting up an investment plan. There’s no minimum amount, and you can turn it on, off, or change it when you want to.

🤔 Keep in mind

All investment products have an element of risk. As share markets go up and down, so too can the value of your investment. Please consider the risks involved before making changes to your investments.