Key points:

- Shopify is a global retail operating system helping customers such as Kanye West, Kylie Jenner, and Oreo sell online and offline.

- It benefits from both social commerce influencers and large brands who want a direct relationship with customers.

- The opportunity and ability to take on Amazon with third party shipping is immense. We believe Shopify could introduce their own marketplace for merchant products, thereby becoming a mini-Amazon.

- Shopify has a high valuation, but we believe the company has significant pricing power and optionality on new services and revenue streams. Shopify’s take rate (commission) is low single digits compared to double digit % rates at competitors.

Shopify is a cloud-based retail platform for e-commerce. For a monthly fee plus payment processing costs, Shopify runs your website infrastructure so you, as a merchant, can concentrate on product. It's become the place to launch online, with a veritable who’s who of influencers including Kanye West and Kylie Jenner, as well as brands such as Nescafé and Oreo. Their most famous merchant partner — Kylie Jenner’s Kylie Cosmetics — launched with Shopify. This year, Jenner became the first “selfie made billionaire,” despite having only five part-time and seven full-time staff. Kylie Cosmetics pays Shopify a yearly fee of $480,000 and 0.15% of sales to run on Shopify’s infrastructure.

Leveling the technology playing field

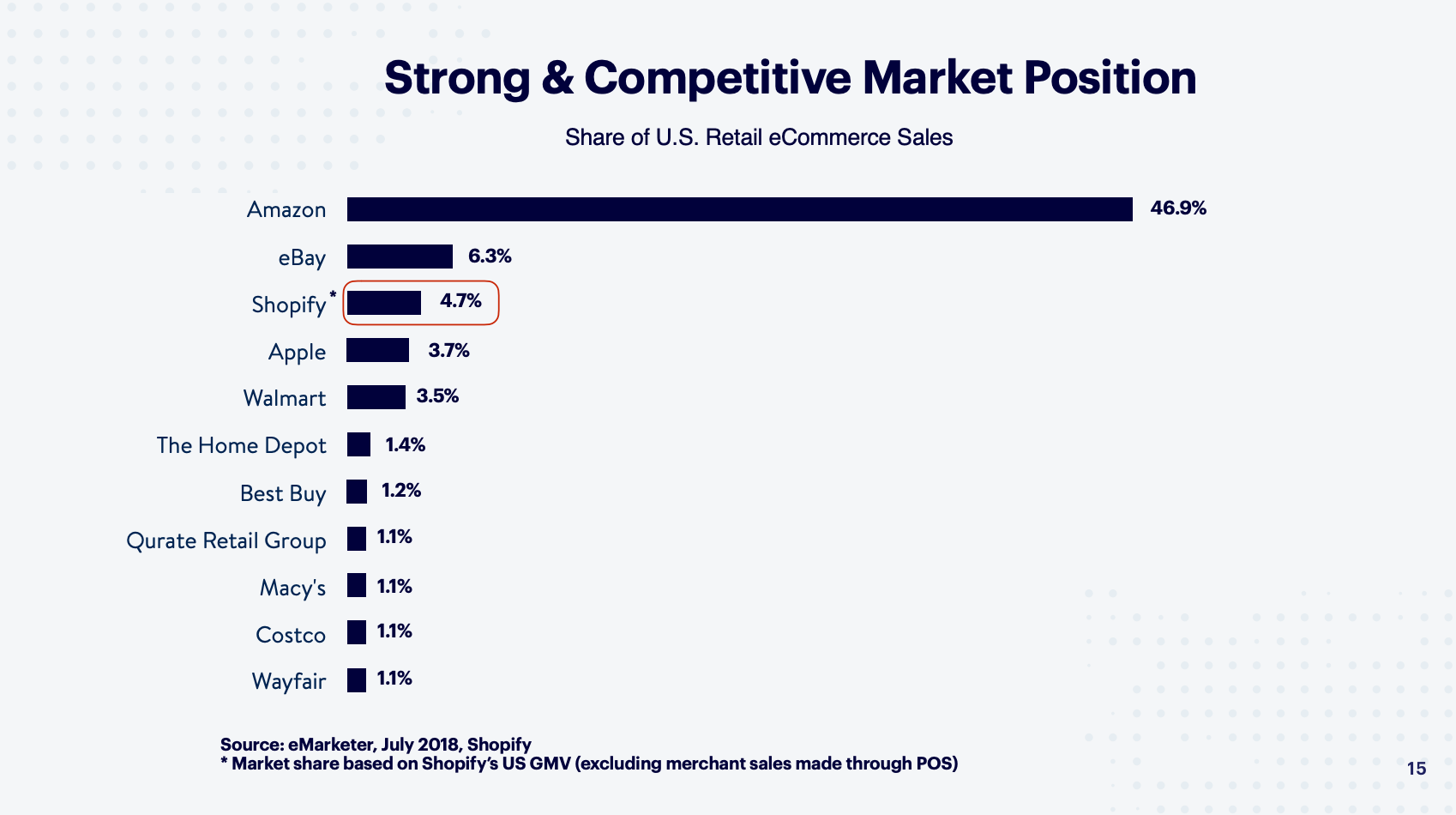

Around 820,000 entrepreneurs of all types and sizes have signed up for Shopify services. Shopify has been so successful aggregating merchant sales that they are now the third largest online retailer in the US. Shopify uses its scale to pass on benefits to merchants, and therefore levels the playing field with better rates on shipping and processing, not to mention capital, by helping start-ups compete with larger companies.

Rise of social commerce

Shopify is benefitting from social platforms becoming sales channels and influencers monetising their followers. Shopify’s multi-channel service helps merchants sell everywhere. The increasing number of channels and complexity makes Shopify services more valuable.

A company for merchants

Shopify offers merchants the best of both worlds: access to scale and technical features, but also control over their brand and customer. There are other website providers like this, but they lack similar scale and features. With its shipping capabilities, Shopify is building a much stronger moat against competitors. Unlike Amazon, Shopify is not a retailer competing with its own merchants.

A great unboxing moment: Shopify’s shipping network

Being based in Australia, we understand the problem of shipping. Shipping costs and long shipment times typically lead to abandoned carts and lost merchant sales. Shipping is hard, if you consider tracking different sized inventory combined with complex pricing. It’s not a one-size-fits-all activity. To solve this problem, Shopify announced its own fulfillment shipping network. This offers brands the ability to have custom packaging, versus shipping their products in Amazon logos. Shopify is expecting to spend US$1 billion over the next five years on its network of fulfilment centres, but Shopify has earned enough trust with investors to do this. In fact, shares rose on the back of the announcement.

Shopify’s own marketplace: to be Amazoned no more?

To be “Amazoned” means to have your business crushed because Amazon entered your industry. Shopify is helping merchants fight back with a retail platform. New brands are growing with Shopify and established brands are signing up to be nimbler. There are no announcements yet, but given their size, we believe Shopify could eventually have their own marketplace offering, listing their merchant products similar to Amazon’s third-party model.

Fastest software-as-a-service (SaaS) growth rate at US$1 billion sales

Shopify’s sales numbers point to their execution. “We made history in 2018: no other SaaS company has crossed the $1 billion-dollar revenue mark at a faster growth rate than Shopify has,” said Tobi Lütke, Shopify’s CEO. Shopify grew revenue 54% when it hit the billion-dollar milestone, executing this growth from headquarters in Ottawa, Canada.

The best business test? Pricing power

Buffett has a famous investment test. “The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.”

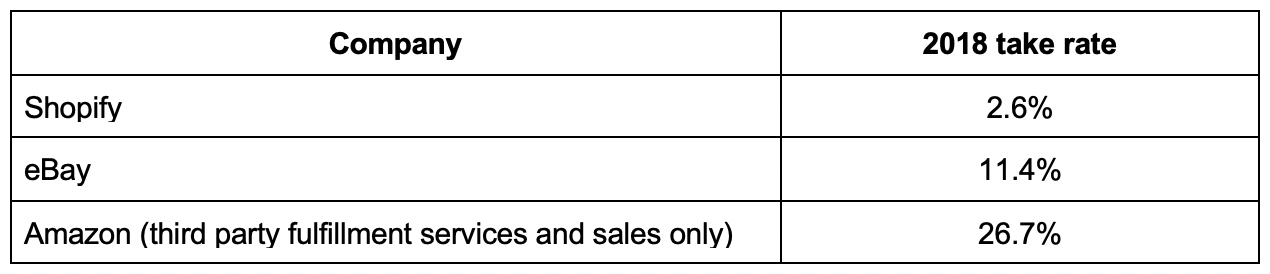

Take rate

Take rate is the % of a transaction that Shopify keeps for facilitating value on their platform, like a sales commission. Basically, the more value added the higher the potential take rate. The calculation is Shopify’s revenue divided by the gross merchandise value (GMV) of sales on their platform.

Shopify’s 2018 revenue was US$1.07 billion / GMV US$41.1 billion, a take rate of 2.6%.

Shopify does not have a marketplace like eBay or Amazon yet, so take rates are not directly comparable, but they are working on third-party fulfillment shipping. Once shipping is rolled out, we believe Shopify’s take rates can move in this direction. Shopify has already moved large customers from fixed to variable pricing.

Fixed to variable pricing for large brands

Shopify Plus is Shopify’s enterprise offering for large and growing online stores and brands. It’s where Shopify has first flexed their pricing power. Initially increasing fixed fees from $995 to $2,000 a month, then a commission-based model of 0.25% in sales with minimum and maximums. They have since removed the cap on commission earnings. Shopify generates a lot of value for merchants and now Shopify is scaling revenue right alongside its merchants. As Shopify adds services such as shipping, we feel they can significantly increase prices as value and customer lock-ins increase, similar to Amazon. Shopify is beginning to look like a mini-Amazon but with a focus on growing merchants rather than customers.

Any reasons to checkout?

Valuations are high, but we believe Shopify has tremendous pricing power, especially as it recently removed pricing caps. There is also optionality in adding extra services and revenue streams, which could increase the take rate. The risk is that we might be paying up for future optionality that might not occur.

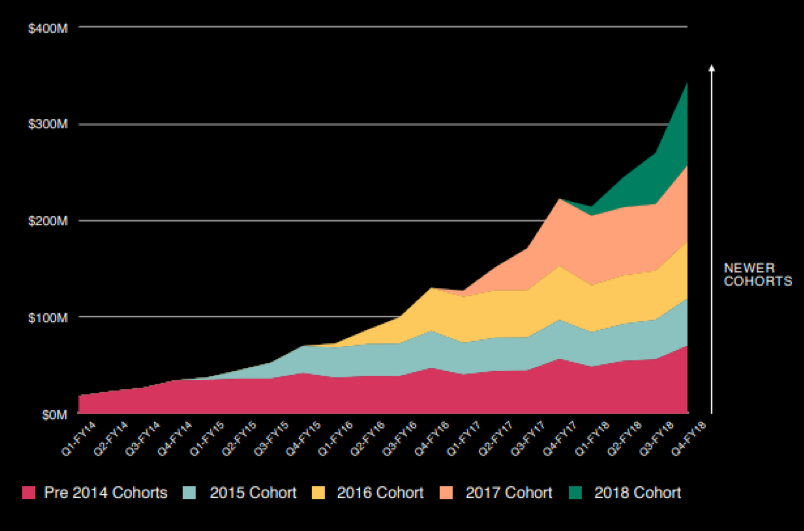

Another risk has been churn due to small business. Churn is high, but we believe this is because the business model makes it easy for merchants to start an online business, and that can lead to high churn if a business doesn’t take off. However, Shopify has shown that successful merchants outweigh those small businesses that unfortunately fail. For merchants on the platform for greater than a year, the average monthly year-over-year growth was 24% last year. Cohort analysis below shows customer revenues increasing over time.

What’s the point? The point-of-sale not just online

Like many great companies, Shopify is benefitting from network effects. More merchants lead to more partners and scale, leading to increased functionality and lower costs, leading to more sales, merchants and partners. We believe Shopify’s big opportunities are expanding from an online store provider to:

- Point of sale, not just online but in-store, with more than 100,000 point of sale devices.

- International only accounts for 23% of sales, expanding multiple languages and currency.

- Shipping adds to Shopify’s value proposition and a potential future marketplace.

We believe Shopify is just getting started with 820,000 merchant customers out of 47 million retail businesses globally. Shopify’s business has optionality, and in our opinion, similarities to Amazon, focused on adding value and moats to their business with untapped pricing power.

The Spaceship Universe Portfolio currently invests in Shopify.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.