One of the companies on our watchlist is Southeast Asian internet company, Sea. The two main pillars of its business are online gaming (Garena) and e-commerce (Shopee). The company is listed on the New York Stock Exchange and currently trades at a market cap of around US$12.45 billion (as at 3rd June 2019). Sea has a strong relationship with China internet giant, Tencent, which owns a third of Sea.

What we find really interesting about Sea is its leading position in e-commerce in Southeast Asia, which is one of the fastest growing markets and still relatively unpenetrated by e-commerce. Only 2-3 percent of retail sales are conducted online compared to 18 percent in China and 13 percent in the United States.

In this blog post, we break down Sea as an investment opportunity.

Garena

As the online population has rapidly risen due to adoption of mobile phones, according to Newzoo, Southeast Asia has become the fastest growing games market in the world. The potential total addressable market is estimated to reach US$4.4 billion by 2021.

As, arguably, the leading distributor of mobile and PC games in the region, Garena is benefiting from these trends. Garena is Sea’s original business — it launched in 2009 — and it is growing its user base rapidly, recording quarterly active users of 271.6 million in 1Q19, up from 126.7 million in 1Q18 across its games. Around 20 million of these users are classified as paying users.

Garena uses the “freemium” model, which allows users to play games for free while the business generates revenue from selling in-game virtual items. The biggest cost for Garena is royalties for its licensed games, which are generally paid to the developer as a percentage of gross revenue from the game.

Although Garena is mostly a games distributor, it has recently started developing games. Its first release, Free Fire, is a big hit. Free Fire is a battle royale-style multiplayer game, optimised for the lower-end smartphones that are widely used in developing countries. For instance, Free Fire requires 400mb of disk space, while PUBG and Fortnite mobile require more than 1gb. The mobile game was the fourth-most downloaded game worldwide in 2018, becoming especially popular in Southeast Asia, India and South America. The app has recorded more than 100 million monthly active users so far. The game accounted for 44.5 percent of the US$231.4 million in adjusted revenue Garena recorded in the fourth quarter.

While competition is fierce for domination of this fast growing market, in November 2018 Garena signed a letter of intent with Tencent detailing that Garena would have “right of first refusal” for five years to publish Tencent's mobile and PC games, including titles such as League of Legends and Arena of Valor. The “right of first refusal” gives Garena an exclusive first look at all Tencent titles it hopes to distribute in Southeast Asia or Taiwan, avoiding direct competition with Tencent and giving it an advantage over competing games distributors in the region such as Moonton and Netease. For instance, the company plans to partner with Tencent and Activision Blizzard to publish Call of Duty mobile in Southeast Asia and Taiwan, in the near future.

Shopee

A digitally engaged population comes with opportunities for e-commerce. While e-commerce is currently a very small share of overall retail sales (~3%), the sector seems poised for takeoff. Google estimates that e-commerce will exceed $100 billion in Gross Market Value (GMV) by 2025, up from $23 billion in 2018.

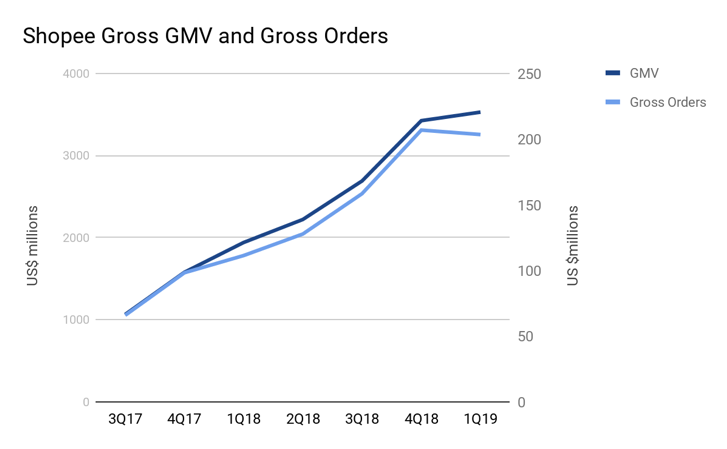

Shopee is well positioned to benefit from these dynamics as a leading e-commerce platform in Southeast Asia and Taiwan that's growing rapidly. Shopee is an early stage business, founded only in 2015. It has waived seller fees in many markets and is spending big on sales and marketing (it spent $147.9 million in 1Q19 while earning $173.3 million in revenue), as the company builds its market share and grows the scale of the entire marketplace. In the first quarter of 2019, it recorded GMV of $3.5 billion up 82 percent year-on-year and Gross Orders of $203.5 million up 83 per cent year-on-year.

According to App Annie, the top e-commerce app in 2018 in Southeast Asia was Alibaba-owned Lazada, followed by Shopee at #2 and Tokopedia at #3. However, it seems Shopee has been gaining ground on its competitors recently. While Shopee recorded 80 per cent growth in GMV in the last quarter, Alibaba reported that Lazada’s GMV growth had basically been flat and sales dipped 4 per cent. Lazada has also experienced some turbulence at the management level, with two CEO changes in 2018.

E-commerce itself is interesting, but even more interesting is the opportunity for the company to carve out a payments platform. Sea is following a well-worn path of e-commerce businesses acquiring customers and making money off payments. The original e-commerce marketplace, eBay, spun off Paypal. In China, Alibaba created Alipay and in Latin America, Mercadolibre created MercadoPago. We believe Sea has a similar opportunity with Shopee to leverage into payments though its platform, Airpay.

Management

Forrest Li founded the company in 2009 and has been the Chairman and CEO since its inception. He is a Singapore citizen, once worked for Motorola in Shanghai, and graduated with an MBA from Stanford University. He first started the business as the synthesis of Tencent and Alibaba in Southeast Asia, with a hyper-local approach.

Forrest retains a 30.6 percent stake in the company, while co-founder and COO Gang Ye retains an 8.3 percent stake.

Risks

The company may not achieve profitability in the future. At the moment, Sea is channeling earnings from Garena, which is profitable, into Shopee, which is currently not profitable. The company raised $1.5 billion in capital earlier this year and Shopee raised $500 million in 2015, to continue to fund Shopee’s efforts to expand and compete against Lazada and Tokopedia. Sea may not be able to achieve profitability if it fails to monetize its businesses effectively.

Separately, another risk for investors is if Sea fails to grow or maintain its user base or fails to compete effectively with its peers. Southeast Asia is an intensely competitive space for both gaming and e-commerce, with deep-pocketed competitors such as Alibaba-backed Lazada. While it hasn’t gained significant traction yet, Amazon entered the region in 2017, and is planning a $1.3 billion investment to expand its operations into Indonesia.

As mentioned previously, there is some earnings concentration, with ~68 percent of 1Q19 adjusted revenue coming from digital entertainment (Garena) and 44.5 percent of that revenue coming from one game title. If Free Fire loses popularity, earnings will be significantly impacted in the short term.

Furthermore, there are geopolitical risks as Southeast Asia consists of many developing market economies which operate under different political systems. Currency fluctuations could also impact Sea’s businesses.

Valuation

Sea currently trades at a market cap of around US$12.45billion and a price to sales ratio of approximately 10x as at 24 May 2019. It’s difficult to value a company that's growing so rapidly and these figures are pre-profit, but we can compare to peer valuations, both in the private and public markets.

There are a handful of privately-owned companies comparable to Shopee.

Walmart bought a 77 per cent stake in leading Indian e-commerce company Flipkart last year, in a transaction that valued the company, based on sales, at around US$20 billion. Similarly, India is a highly attractive market for e-commerce. Flipkart had sold GMV of $7.5 billion in the year ended March 2018. As a point of comparison, Shopee recorded around $11.9 million in GMV in the last 12 months.

In its Series G funding round in November 2018, Tokopedia raised $1.1 billion, valuing the company at $7 billion. While Tokopedia commented that its GMV had quadrupled, it did not disclose the exact figure, though we’d expect it to be lower than Shopee.

To value Garena, the best point of comparison is probably Chinese gaming giant Netease. Netease has a similar split of revenue from the games they developed in-house and games they are licensing from other developers. Netease is not growing as fast as Garena and currently trades at forward price to earnings ratio of 23x. If we use forward earnings of $150 million for Garena and a higher growth multiple of 30x, this would value the business conservatively at around $4.5 billion

Bottom Line

Sea is a high risk, (potentially) high reward kind of investment. The company has a leading position in two large, fast-growing and potentially lucrative markets: online gaming and e-commerce in Southeast Asia. However, it faces intense competition from all fronts. We’re keeping our eyes on this one at Spaceship.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager has considered investing for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s potential investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.