Someone who flogs shares for a living - generally called a broker - can make a killing in two ways.

They can sell 'confirmation' or 'certainty'.

'Confirmation' is a confidence trick, not unlike a shop assistant lavishing praise on your choice after you've already made your decision.

We like to hear others compliment us on our choices.

If you’ve already decided you want to buy Netflix shares or A2 Milk or Tencent, the best way for your broker to earn her commission is to congratulate you on your choice, reinforce it with some sexy sounding statistics, and take a clip of your trade.

‘Certainty’ is similar. Markets move around, volatility appears threatening, the notion of risk lurks around every corner. At the end of the day, everyone just wants to know that everything will be okay.

So brokers respond to that. They formulate price ‘targets’ and develop forecasts designed to tell you where the share market will be in six months, twelve months, two years.

Their ‘certainty’ is catching, it’s calming.

If your broker tells you, “I don’t know”, the chances of you going through with your trade are probably less.

If she says ‘we expect things to be at X in six months’ that might sound like a level of certainty you can respond to.

But the truth is, she can’t be completely certain.

Volatility

Once you know that ‘confirmation’ and ‘certainty’ strategies exist in the broking business, you know how to keep an eye out for them.

And rather than look for information that’s going to qualify a broker's certainty or confirmation strategies , you can develop an investment outlook that is based on patience, longevity and logic.

But to do that, you first need to expect volatility.

Volatility is when the prices of things move around a lot. To some, it can be the frightening part of investing.

Every major sell-off in history has been driven by a mix of economic concerns, monetary policy shifts, geopolitical tensions, or some other source of worry that might make people sell their investments and avoid locking in losses.

(In other words, it looks like I might lose my investment so I better get out now!)

The details are different each time. But structurally, it’s generally the same story: it’s risky out there.

It might be the cause of that cold feeling, that drop in your stomach when you open your Spaceship Voyager app and see your balance has slumped.

The market is collapsing! Your money is lost!

Often your immediate reaction is to yank everything out, put it somewhere ‘safe’, hide in the dark until the storm blows over, before you venture back into the market.

The truth is, panic selling is a terrible strategy. Especially when you’re invested in a managed fund (which tracks many shares, rather than one specific company).

The share market generally has a year of negative returns about one year in three. Drastic sell-offs happen. The Global Financial Crisis was a blinder. The dot.com crash was vicious. And in 1987 “Black Monday” was, you know, dark.

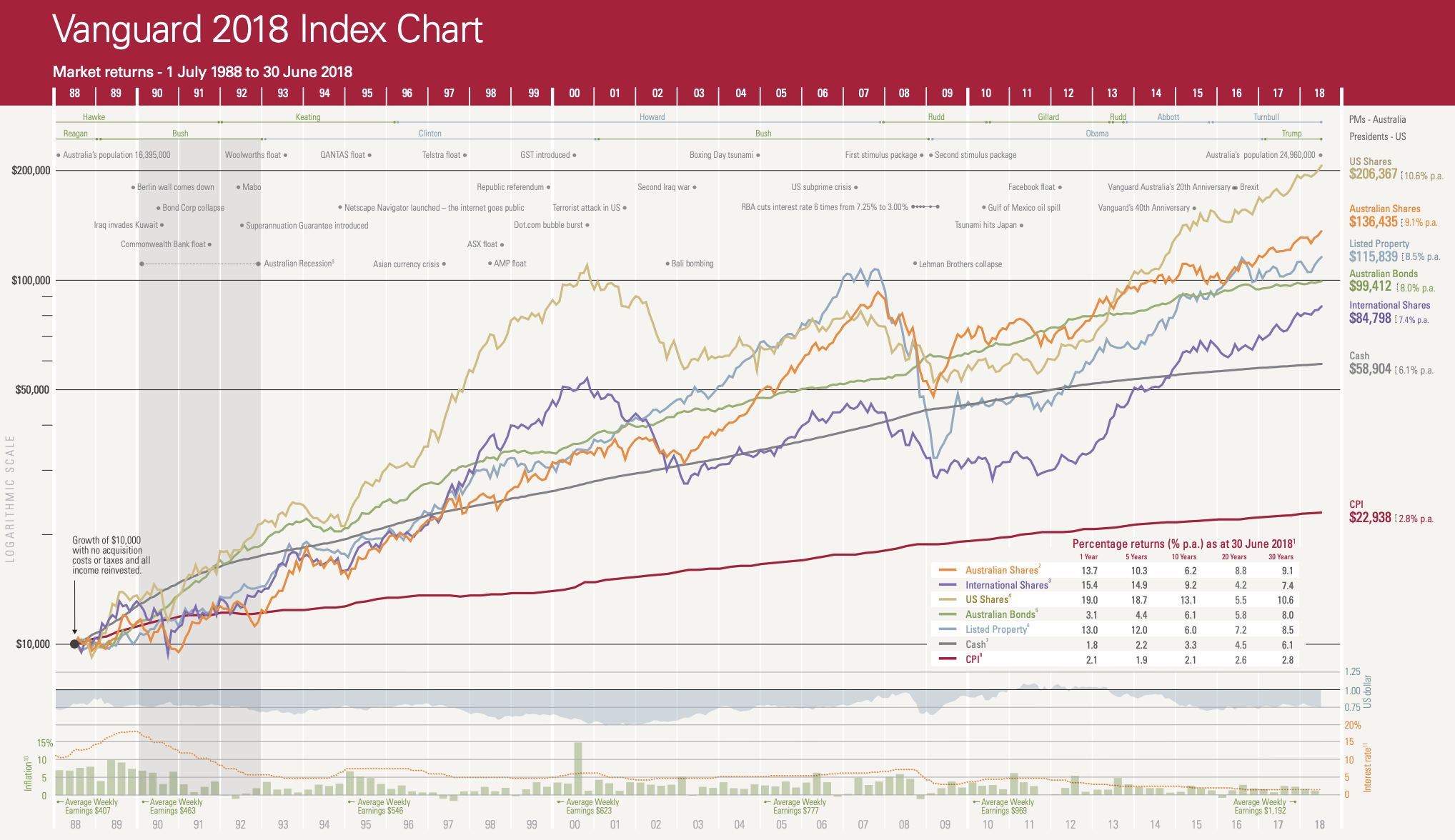

But look at the big picture:

There are three clear falls in share prices. Can you spot them?

(Hint: the ‘87 crash is at the far left.)

But what’s worth looking at is the general direction of the chart. It’s moving up and to the right, economic growth is propelling the price of shares higher, over the long-term.

If you’d panicked and tried to avoid or take advantage of market volatility when it hit - during those dark sell-off days - you’d have missed out on that steady overall growth.

Long-term investing

You’ve got to hand it to the day traders, the speculators, and the punters.

They’re attempting a feat more difficult than an archer trying to hit a sparrow having a seizure… 800 metres away.

And despite the terabytes of information they have at hand, short-term investors typically don’t have much higher odds of success.

Long-term investing stems from a deep sense of patience. It takes time for companies hoping to expand and grow to actually… expand and grow. Understanding that diversification and time are two of the most powerful tools in an investor’s arsenal is key to any successful strategy.

But there are plenty of contrarian investors out there, and it’s easy to find sense in the notion of bucking the trend.

After all, thinking outside the box and ignoring the rest of the market has made hedge fund managers all over the world billions and billions of dollars, right?

Sure - but it only works if you’ve got time on your side.

By bucking the market trend in the short-term, you’re yelling “gold and blue” while the rest of the market hears “white and gold”.

Because the market price of any share is the net result of the market’s current view.

By trying to beat the market, you’re saying “I think you’re wrong” and effectively trying to zig while everyone else zags.

And this may be a fine strategy! As long as you have the patience to wait for the market to agree with you. It can take a long time before other investors realise a company’s full value and reflect that in the share price.

As the most over-quoted, but incidentally the most successful, investor in the world says:

“The stock market is designed to transfer money from the Active to the Patient.” - Warren Buffett.

The other fabulous benefit of remaining a long-term investor, rather than someone who panics during volatility, is if you find, buy and hold a quality business, you can reap the rewards for a long time, courtesy of the wonderful benefits of compounding.