Lenin is quoted as saying: “There are decades where nothing happens; and there are weeks where decades happen.” It couldn't be a more apt description for the global health crisis and economic disruption we find ourselves in today.

We thought it would be worthwhile for the investment team to share what we’ve been analysing throughout the last few weeks and ponder what could lie ahead. Of course, there are no crystal balls. But history and economic logic can be a guide.

We’d also like to share how we’re positioned in the Spaceship Universe Portfolio in terms of weathering the storms ahead. Given the portfolio is an actively managed fund, we’re always trying to find the companies that have the best investment prospects, in line with our “Where the World is Going” investment strategy, for the portfolio.

The economy

Coronavirus has brought the world to a standstill.

With most of the world under some kind of lockdown or practising social distancing, life as we knew it has become upended. The global economy is currently experiencing the deepest and quickest downturn in history (including the 1930s).

Economists are calling coronavirus an exogenous shock — that is, something that has a big impact but comes from outside the system. (Not unlike a hurricane that blitzes through cities and towns leaving a path of destruction!) Having said that, a deadly virus that lives within humans and is spread by human contact doesn’t sound very external.

The fear of catching it from having a meal at a restaurant or taking public transport is very real. Even in Sweden, where there are few restrictions, restaurants and movie theatres are struggling. Across the world, there’s the added impact of people reducing their discretionary spending amidst a backdrop of unemployment and financial insecurity.

The good news is that many of the world’s governments reacted quickly, helping to deliver the biggest economic stimulus packages in history to help cushion the blow. Stimulus payments will provide economies with a buffer as they emerge from the health crisis.

But how will countries pay for the additional spending?

Money, credit, and debt

The global economy was not in the best state of health before the pandemic.

In fact, 2019 saw the slowest global economic growth since the global financial crisis (aka the GFC), against a backdrop of low interest rates, expanding central bank balance sheets, and high levels of government debt.

There’s little appetite for post-crisis austerity, so governments will likely monetise the debt instead. Essentially, central banks will print money and increase the money supply. This is called quantitative easing (or QE), and it allows governments to buy government debt issued to pay for the coronavirus stimulus.

The reason some governments in developed countries believe they can print money without consequence is because of historically low inflation.

But with oil prices turning negative for the first time in history, deflation rather than inflation is the immediate threat. This threat is exacerbated by high levels of debt in the economy. As the economic shock takes its toll, debt defaults and restructurings could hit various players, especially leveraged lenders such as banks.

Deflation causes financial distress because the overall level of debt rises in “real” terms and consumers hold off on purchases as they expect prices to fall. The ensuing financial distress then further exacerbates deflation, creating a nasty cycle.

Society will undoubtedly overcome the health and economic challenges of coronavirus but it’s unlikely to be a quick fix. The global economy is likely to come out the pandemic more indebted and dependent on quantitative easing than ever.

The stock market

Warren Buffet is quoted as saying: “Interest rates are like gravity in [stock] valuation. If interest rates are nothing, values can be almost infinite.”

It’s not the easiest concept to understand, but essentially, quantitative easing and zero interest rates make stocks and other risk assets more highly valued, because they make any stream of earnings worth more money.

In this environment, investors can’t get a decent return on their money in traditionally safe investments, such as government bonds, so they turn to riskier investments.

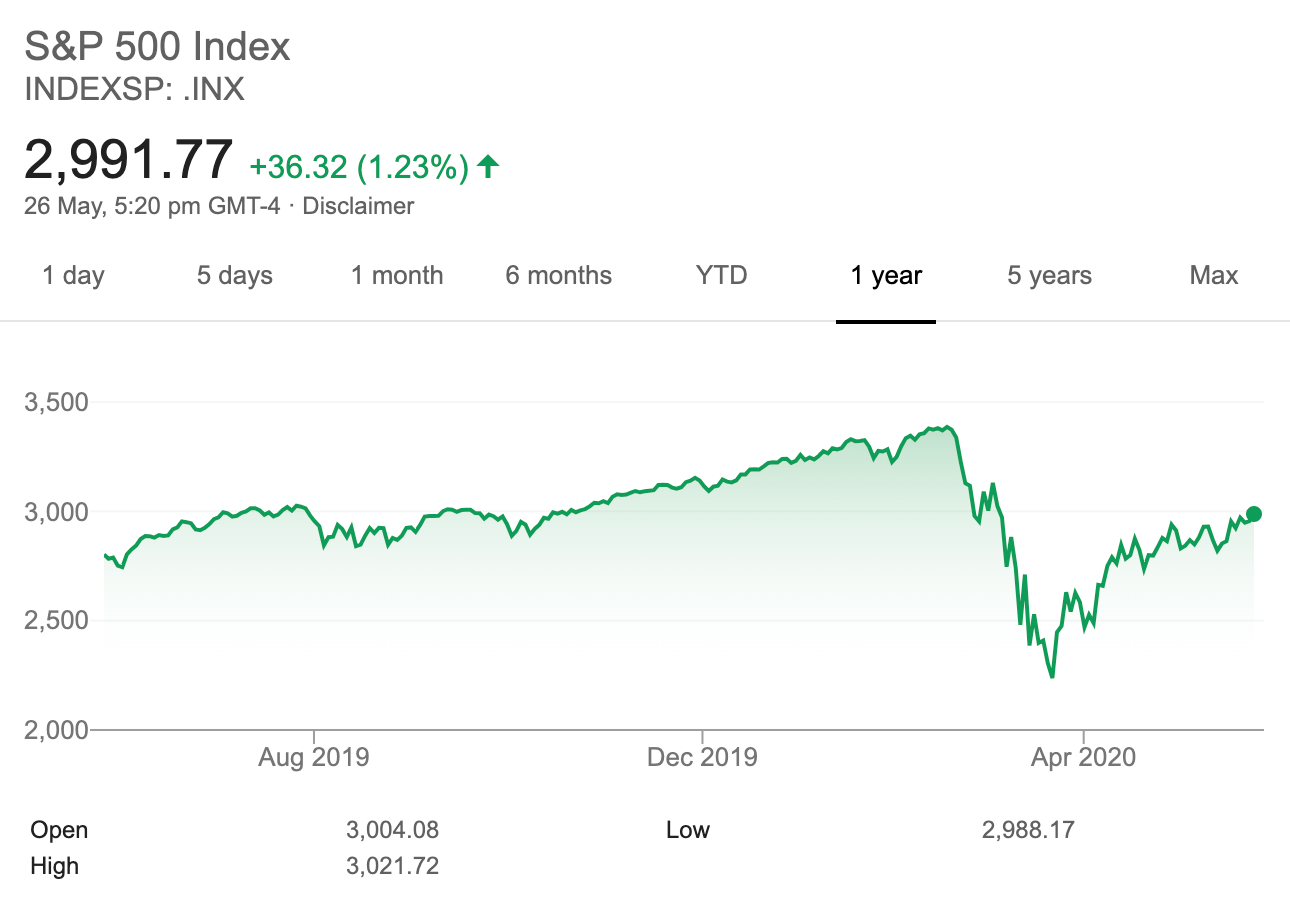

The outlook for stocks is mixed. The real economy is not doing well, though some individual companies are thriving in this environment. Central banks are throwing everything that they have at financial markets, aiming to prevent a big crash in asset values. So far it has worked, with the S&P 500 bouncing back nearly 34% from the lows in March.

Some investors say this is a bear market rally, and the market will eventually retest its lows. History suggests a few bear market rallies can be expected in a major stock market crash. There were six rallies in the Great Depression, five in the dotcom bubble and four in the GFC. Markets do not crash in one big move but in an oscillatory drop and pop manner.

But policymakers seem determined to not let history repeat itself. The degree of monetary intervention is unprecedented in the history of financial markets.

In the US, the Federal Reserve has pledged to “do whatever it takes” to help the American economy and prevent a sell-off in assets. The Federal Reserve is printing money to buy everything from municipal bonds to junk debt.

It’s hard to know the outcome from this kind of distortion. If central banks succeed in maintaining investor confidence, we might not see the bargain basement stock prices during the GFC, when equities fell 50% from top to bottom.

Where the World is Going

At Spaceship, we believe in investing where the world is going. Hardly anyone alive today has endured a pandemic this severe. And with social distancing rules potentially in place until a vaccine is available, we think we could see some permanent shifts in behaviour.

People working remotely could become the norm. If China is any guide, returning to the office could involve temperature checks, no elevators, social distancing buzzers, and the return of cubicles to keep employees safe. It might be less risky for companies to keep office workers at home. In an economic downturn, offices could be seen as a luxury and an area where companies look to cut costs.

As some workplaces go remote, there may even be an exodus from densely-packed cities to rural areas. Large physical gatherings of strangers will be viewed with caution from now on, with social distancing potentially becoming the norm.

This could extend to public transport, sports games, concerts, conferences, casinos, large hotels, cruise ships, movie theatres, and restaurants. Even minor changes in consumer behaviour can lead to business models that are no longer viable.

The only hygienic gatherings are digital.

Social distancing and lockdowns will accelerate existing trends such as growth of e-commerce and the shift from linear television and movie theatres to on-demand streaming.

What is probably underestimated is the forced digitalisation of sectors that were previously resistant to change, such as formal education and healthcare. The transition to telemedicine has practically been overnight, with telemedicine becoming the first line of defence against the spread of coronavirus.

Social distancing may also lead to less obvious effects. For instance, we could see social distancing reverse the long-term trend of “the less car ownership, the better” and thus dent the growth of the sharing economy. In Wuhan, car sales are experiencing a boom, while people are reportedly avoiding public transport and DiDi, the ride hailing service.

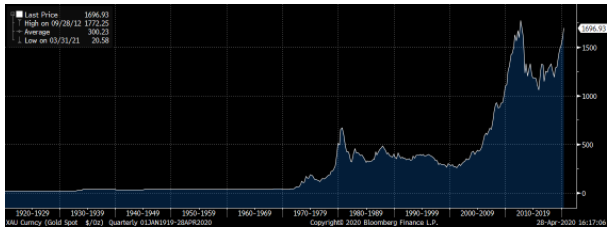

The debasement of fiat currency could fuel the rise of gold and Bitcoin as people look for assets that aren’t impacted by slowdowns in business activity and have a finite supply.

Positioning the Spaceship Universe Portfolio

We believe the Spaceship Universe Portfolio may be well positioned to weather the storms ahead. It’s not an unfavourable environment for tech companies that have clean balance sheets and will ride the tailwind of increased screen time.

We own meaningful exposure to some of the “stay-at-home stocks” that have been among the top-performing stocks in this period and will continue to benefit from robust demand. These companies range across gaming (Activision Blizzard, Netease, Tencent and Sea), e-commerce (Amazon, Shopify, Alibaba, Mercadolibre), and productivity software (Slack, Microsoft, Adobe).

Tech giants with more cyclical exposure such as Facebook, Google and Twitter (all reliant on digital advertising) could weather some sharp slowdowns in growth. But thanks to strong balance sheets and growing user bases, they can come out the other end stronger. The same is also true for some of our other consumer-facing stocks, including Apple, Nike and Lululemon.

Finally, our strategy means we hold limited investments in the industries most vulnerable in this virus-led economic downturn. We do not own any energy companies, airlines, or banks. As Bryna wrote in her recent newsletters, we reduced our exposure to travel-related companies, selling Boeing, Booking Group, Webjet and Trip.com. We also recently sold Sydney Airport. We believe one of the last restrictions to be lifted will be international travel and the sector will be especially challenged, which is why we made these choices.

The Spaceship Universe Portfolio invests in NextDC, Activision Blizzard, Netease, Tencent, Sea, Amazon, Shopify, Alibaba, Mercadolibre, Slack, Microsoft, Adobe, Facebook, Google, Twitter, Apple, Nike and Lululemon at the time of writing.

The Spaceship Index Portfolio invests in Boeing, Sydney Airport, Tencent, Amazon, Alibaba, Microsoft, Adobe, Facebook. Google, Apple and Nike at the time of writing.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.