I started my first full-time job in February 2016. I was working in digital media at a female-dominated company, and every day was like going to a fashion show. My older colleagues would don Ginger & Smart separates for client meetings, while my peers would float around in colourful Zimmermann and Camilla mini dresses.

We were paid monthly, and just before my first paycheck hit my account, I remember expressing excitement over my first big girl pay day.

“What are you going to do with it?” I was asked. “I’m not sure. I'll probably just save as much as I can,” I replied.

“You should buy yourself a designer bag to mark the occasion,” someone suggested.

“Yeah… get something classic and consider it an investment,” echoed another.

I should get a Chanel, I told myself.

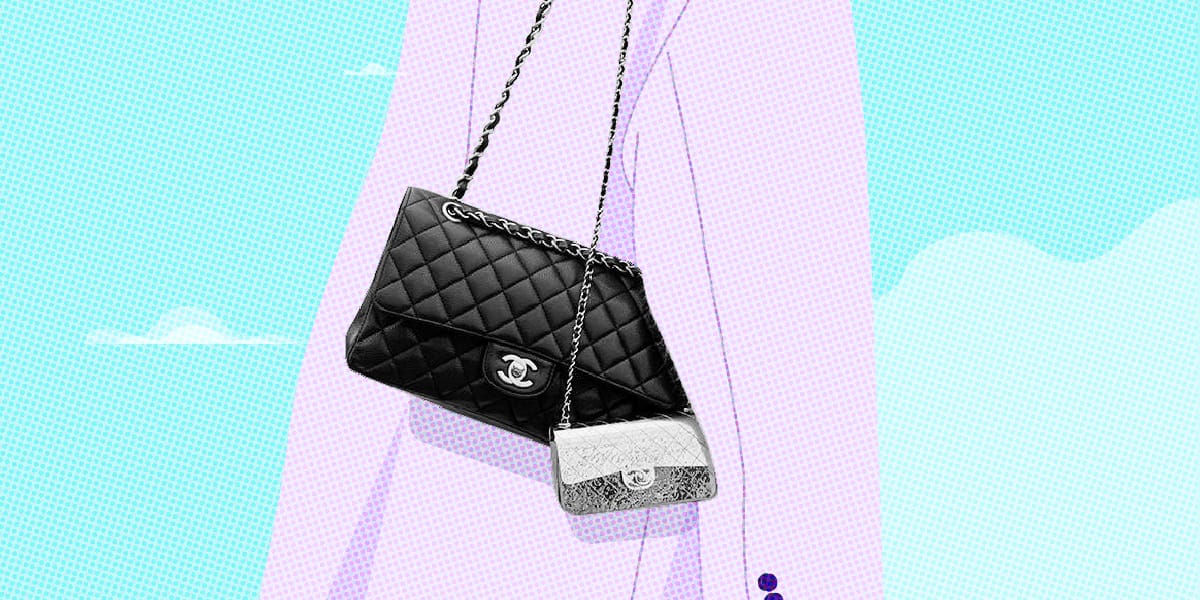

While rose gold and wine-coloured upholstered Boy Bags were all the rage, I decided that a black, medium-sized Chanel Flap bag was probably the best investment. It’ll never go out of style, I thought.

But at a then-retail price of US$4900 — which was more than AU$6700 at the time — I would have had to save my salary for 3-4 months to be able to afford it. And live on two-minute noodles and prayers in the meantime.

Needless to say, I didn’t buy the bag. And it’s one of my biggest fashion regrets. Today, a Chanel Medium Classic Flap retails at a staggering US$10,200. In just over six years, the price of that bag has more than doubled.

Quite frankly, I found this price jump staggering. And I needed to figure out what has caused its value to increase so quickly.

What makes this bag so damn expensive?

There are many factors that have contributed to the price increase of the Chanel Medium Classic Flap bag. Arguably, the most significant is the power of the Chanel brand.

Branding is an important function of marketing, which has its roots in marking — or quite literally, branding — the producer of the goods up for sale.

It has now evolved to encompass much more than that. Branding is all about creating a positive perception of a company and its products in the consumer’s mind. The brand is shaped by all the experiences consumers have with the brand, which include things such as seeing the brand logo and colours in advertising, interacting with customer service representatives, and browsing products in store.

The real power of luxury brands is that they create strong emotional connections with consumers. The Chanel brand, for example, is characterised by ideas of wealth and sophistication, which they leverage to create aspirational advertising campaigns that make people feel like they need to own these products to feel successful or fulfilled. In this way, consumers are also buying into the brand for the psychological payoff of feelings of prestige and high social status — which are all feelings that legitimise the high prices of Chanel products.

Part of what substantiates Chanel’s high prices is their use of high-quality materials and expert craftsmanship. The Classic Flap products are made using lambskin and caviar leather, which are some of the highest quality leathers available, as well as gold and silver hardware. These help create a perceived quality and sense of superiority of the product.

Inflation is another factor that has impacted the rising cost of the Medium Classic Flap bag. In 2021, the price of the bag increased from US$6,800 to US$8,800. A spokesperson for Chanel told Bloomberg in 2021 that the increase in price was due to exchange-rate fluctuations and changes in production costs. The brand also claims that this move was also part of a bid to make sure its bags are sold for roughly the same price around the world.

This wider pricing strategy is also related to the company’s limited supply and distribution strategy, which works to maintain the exclusivity of its bags — which is why new Chanel products are only sold in its own boutiques and select high-end department stores. They’re not easily accessible, either in terms of price or in terms of the retail point of purchase, and they never go on sale. In fact, LVMH has been notorious in the past for destroying excess stock, as opposed to discounting items to free up inventory, which is another tactic used to control supply and maintain the luxury image the house has worked so hard to build.

Is a designer bag considered an investment?

So, if the price has gone up so much, does that make the Chanel Medium Classic Flap bag a good investment? Maybe, maybe not.

Whether a Chanel bag is considered a good investment comes down to how we define what an investment actually is. In the fashion industry, ‘investment items’ often refer to pieces that stand the test of time, which can be worn over and over again over the years. Given the fact that this bag has been produced since the 1950s, has a classic design and consumer demand for it still remains high, you could consider it a good investment in terms of your cost per wear.

However, if we want to take an economic perspective, an investment is the decision to purchase an asset, which has the potential for future economic gain. In this sense, buying a Chanel bag can be considered investing in an asset if you’re planning to — and able to — sell it in the future.

Whether this is a good or bad investment comes down to whether you’re able to derive a gain or a loss. And to determine that, we need to look at the second hand market for luxury consumer goods.

Can you actually get the price through resale?

The secondhand fashion and luxury market is big, and it’s getting bigger. According to the Boston Consulting Group's research on What an Accelerating Secondhand Market Means for Fashion Brands and Retailers, the second hand luxury goods market has nearly tripled in size since 2020, with a value estimated between $100 to $120 billion worldwide.

The market has seen the emergence of prominent players, such as The RealReal and Vestiaire Collective, who have become key players in facilitating the buying and selling of second hand luxury goods.

However, one striking characteristic of the second hand luxury goods market is its decentralised nature. Unlike traditional high-end retail, this market is not dominated by a few big players. Instead, it is comprised of various online platforms, boutique stores and individual sellers.

The pricing dynamics in the second hand luxury goods market are influenced by several factors. Notably, the condition of the product plays a crucial role in determining its price. Second-hand Chanel bags, for instance, may command different prices depending on their condition, ranging from mint to gently used. Additionally, the motivation of the seller also affects the pricing. Some sellers may be looking to sell quickly, leading to more competitive prices, while others may be more patient and hold out for higher offers.

While the fragmented nature of the marketplace means that consumers have a vast array of choices when it comes to products and prices, it can also make it difficult to assess the value of products on the market.

Which brings us back to the question, is a Chanel bag a good investment?

We asked Maddy, a Spaceship Investment Analyst, her thoughts:

“In terms of the investment side of things, while the retail price of a new Chanel Medium Classic Flap currently sits at US$10,200, investors may be able to make a profit if they’ve held the bag for a number of years and the bag is in very good condition.

If an investor hopes to derive use value from the bag, and indeed does use the bag often, wear and tear are likely to have a big impact on the resale price.

However, I think that luxury bags as an ‘investment’ in the economic sense is a myth. This Brand Value Index highlights that it’s only really possible to make a gain from reselling a Hermes Birkin or a Chanel Classic Flap bag, and then, you also need to consider the costs associated with selling. You’ll need to pay to get the items authenticated, and typically, the consignment store or resale site will take a large cut of the sale.

So while I don’t believe that luxury bags are an ‘investment’, I do see the benefit in owning a classic, quality bag that will last forever and may hold some value if you sell it, which is a notable distinction from most store-bought items that are worth nothing once you leave the store.

We do invest in the companies that make them, though! We currently hold Hermes International in our Spaceship Origin portfolio, which is an index-like, rules-based portfolio. There are not many companies that have the ability to integrate inflation seamlessly into their prices, all on the basis of a psychological desire for their products, which is something luxury brands are able to do.”

Some of our Spaceship Voyager portfolios invest in Hermes at the time of writing.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.