InterActive Corp (IAC) is one of the most important internet companies you’ve probably never heard of.

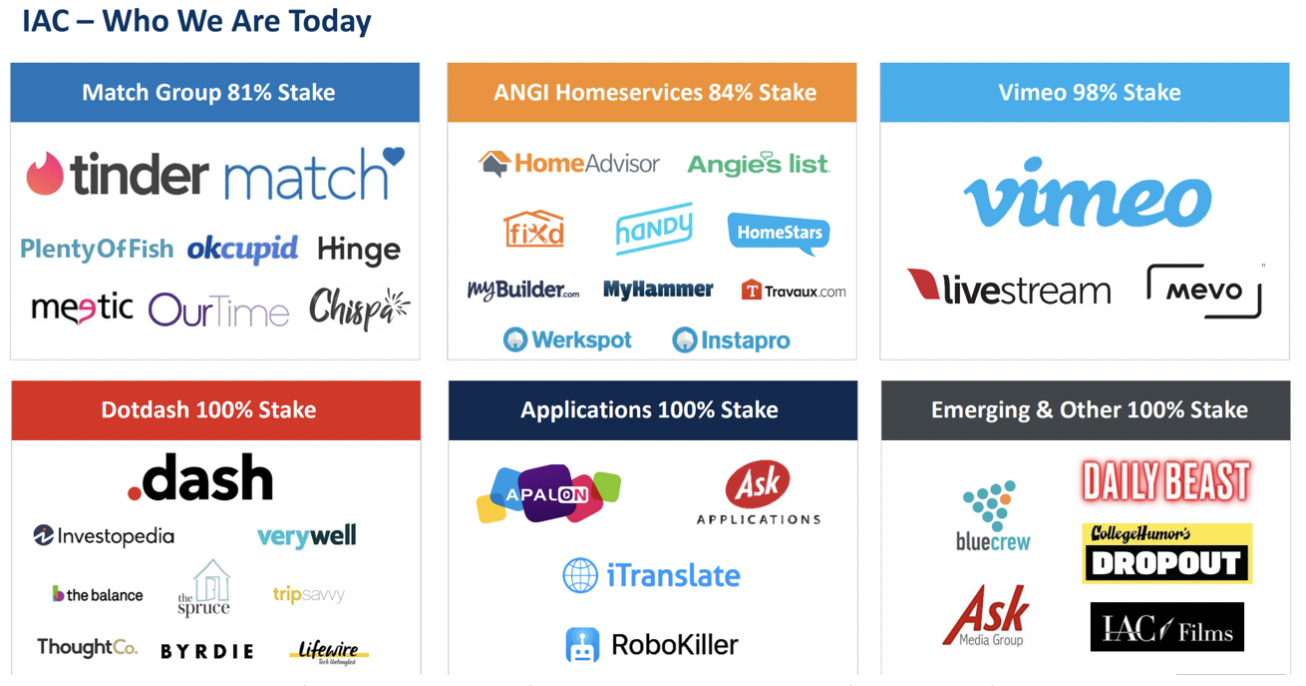

You can hardly use the internet without encountering one of their companies. They’ve got you covered for online dating with Match (including Tinder), home improvement help with ANGI Homeservices, news with Dotdash and Investopedia, and video creation with Vimeo.

IAC is an internet conglomerate but we believe it's more like a listed internet incubator similar to Y Combinator.

They don’t back startups, but instead they back promising internet platform companies matching supply and demand for services whether it's dating, travel or home services. IAC offers them capital but also operating experience, investment expertise and discipline, and a long term investment horizon to build great companies.

IAC also own two public companies, with the most important asset being their 81% holding of Match. Current portfolio of companies below.

Matching with Match

Match dominates the online dating world operating 4 of the top 5 grossing dating apps in North America, including Tinder. Tinder’s app made online dating “cool”. Before Tinder, online dating was often seen as a sign of desperation. Tinder made online matches easy. Swiping right on Tinder shows your interest in whoever is shown on screen. If both parties swipe right, it’s a match and a conversation can begin.

Tinder is the second largest grossing non-gaming app on Apple’s iOS store just after Netflix. We believe Tinder’s pricing power is tremendous, their Tinder Gold initiative has been a huge success, users pay extra to have the ability to see who has liked you, which is a huge time saver.

Facebook’s dating product is a risk but so far Match has not seen a negative impact, validating the singular focus of dating apps. We believe users don’t want to mix Facebook or other social media with their dating lives.

ANGI Homeservices

ANGI is a similar marketplace model, connecting homeowners with service professionals (tradies) for home repair and maintenance. It aims to be the one-stop hub for home services. A customer submits a service request and is matched generally with four service professionals. Customers can then review profiles, ratings and reviews and select the best option to meets their needs.

The average homeowner in the US does 6-8 jobs a year, IAC believe the proper number should be around a dozen jobs a year. Currently ANGI carries out 1.8 jobs for each customer fulfilling 23 million service requests from 13 million households with 250,000 service providers/tradies.

It’s a large market that, at the moment, is mostly offline. Their major competition is word of mouth which accounts for around 90% of the market.

Vimeo

This is the all-in-one video solution for creation, collaboration and distribution, and it used by creative pros as well as businesses. Most video platforms compete for viewers, whereas Vimeo serves creators and businesses.

It’s a gold rush for content creation, with Vimeo selling creators the picks and shovels. Many websites use video and need tools to create them. Tesla and Patagonia are customers.

The boss

The man behind IAC is Barry Diller.

He is an old-school Hollywood media mogul who has transitioned into the digital age. He co-founded the Fox network with Rupert Murdoch, greenlighting The Simpsons before going all in on the internet.

He has turned IAC into an internet platform builder, leveraging the large platforms (Google, Facebook) with expertise across customer acquisition and monetisation to grow industry specific platforms that match supply and demand in dating, travel or home services.

IAC has a history of spinning out companies once they are successful and able to stand on their own two feet. The list of companies spun out is below.

The market value of these spun out companies dwarf the parent IAC.

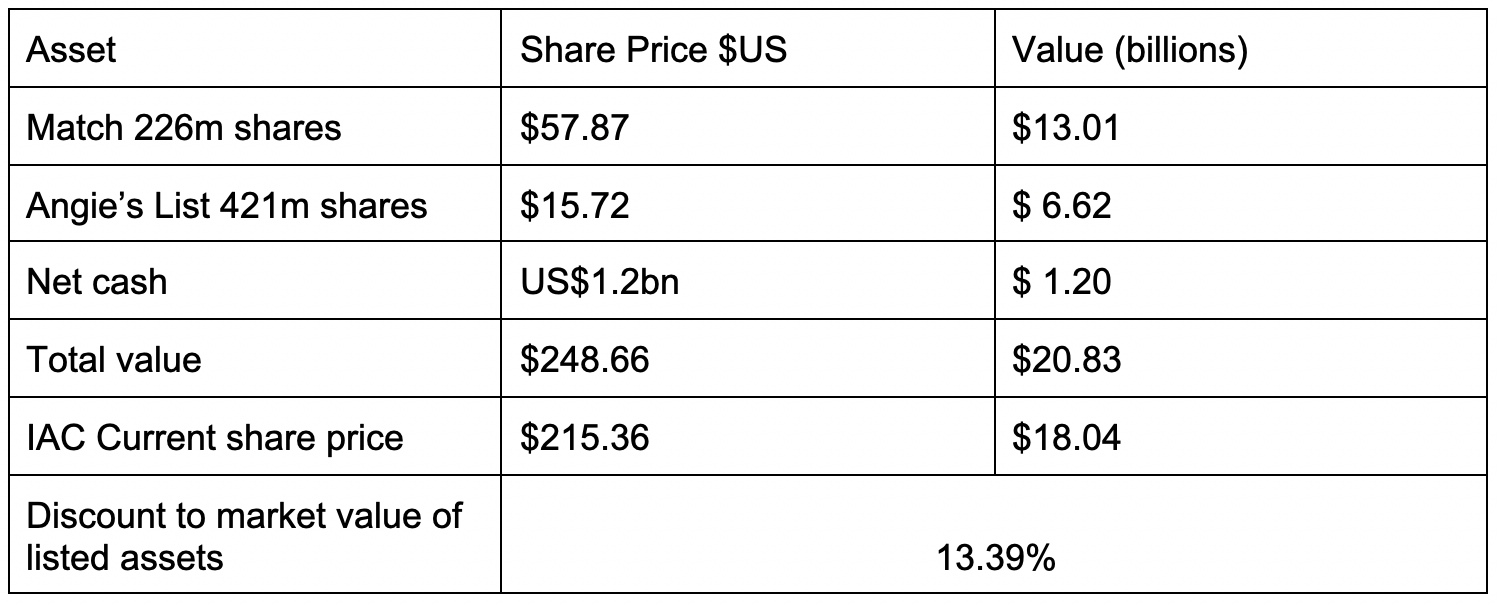

IAC trades at a discount to the value of its public investments

We believe IAC shouldn’t trade at a significant discount to market value like most conglomerates, because they are shareholder friendly. This means they take action when the discount becomes too great by repurchasing shares, paying dividends and spinning off companies (typically not a taxable event) to create value.

A picture is worth a thousand words (or a billion dollars)

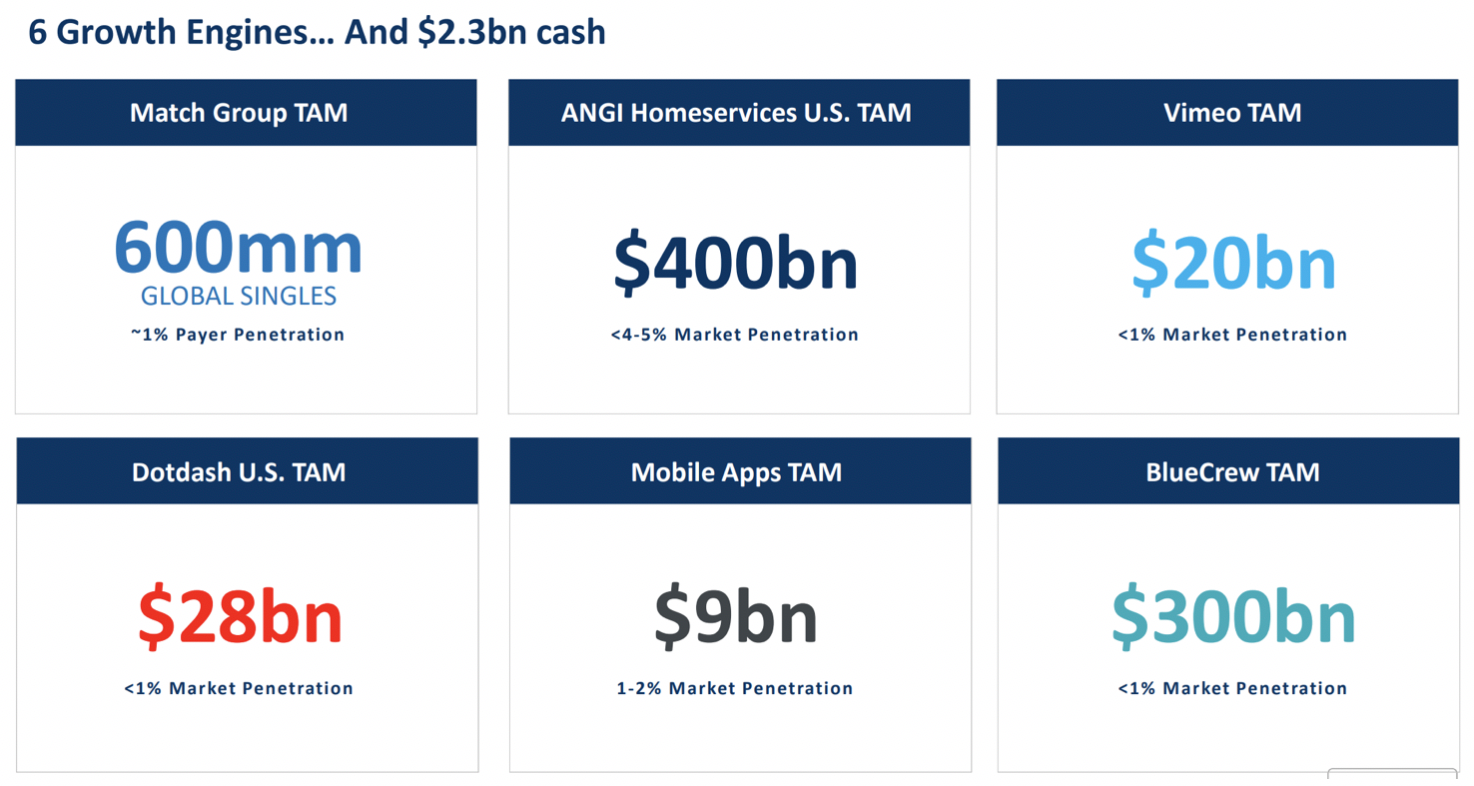

We love companies that explain their opportunity simply. The slide below captures IAC’s potential. Match and ANGI Homeservices have leading marketshare yet they are still low single digit penetration of their addressable market opportunities. See penetration below.

This is known as Total Addressable Market (TAM) and IAC has plenty. ANGI’s has less than 4-5% market share and its ‘take rate’ (commission on services) is just 4-5%. As such, we think both pricing and share can expand over time.

Match believe that of the 600 million internet-connected singles in the world, 400 million have never even tried a dating product. Match daily average revenue per user is US$0.58.

We believe IAC can execute on these markets as they are one of the best investors/builders in marketplaces and platforms. They are experts at connecting supply with demand whether the industry is hotels, singles or homeowners. It’s a great skill to have.

Competition? Competing against what we used to do

IAC has competitors but the largest roadblock seems to be the traditional way people do things.

Meeting other singles through friends or the pub, or word of mouth for tradies. Competing against more inefficient matching processes is an activity we like to swipe right on.

These marketplace, platform businesses are extremely hard to get going but once they have traction they benefit from the network effect. More users, equals more activity leading to more users. They become more valuable as users grow. Once momentum has begun its hard for the flywheel to stop.

Platform vs platform

The real risk are the large internet companies, Facebook, Google and Apple. IAC is reliant upon these platforms for distribution.

These app/advertising platforms are increasingly competing with customers like IAC. IAC generally pay 30% of their revenues to these app stores.

There is potential upside if app store commissions reduce. It’s a major risk but the ability to distribute through their platforms is too large to pass up. The best way to grow a platform is on another platform, and at this stage we think the reward outweighs the risk.

The Spin Kings (in a good way)

IAC is one of the leading internet conglomerates, we think Barry Diller and his team have been great allocators of capital.

Importantly they act more like an incubator, not backing start ups but backing promising companies early on.

If successful, those companies are spun off, giving shareholders a stake in the new company.

The new company gains independence from the parent so they can allocate capital themselves and better attract and reward staff with their own listed shares.

This conglomerate/incubator process is a tightrope IAC appear to have balanced well.

Whatever the internet makes more efficient, mobile first and digital, you can bet IAC will be there incubating the next great platform.

The Spaceship Universe Portfolio currently invests in IAC.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.