If you want a free tip about investing, pay attention. There is one thing that all investments can have in common, and hopefully you have it on your side.

The secret behind investment growth is… time.

As an investor, time can be one of your most valuable currencies. So, if you’re earlier on your investment journey, you might be in pole position to reap its rewards.

Because with time, you can grow your money thanks to the power of compound interest.

Before we can appreciate compound interest, though, we need to start at the beginning, and break down what compound interest is and how it works.

Consider your savings account.

If you have money that you save in your account, your bank might pay you a portion of interest on top of those savings. Interest is usually a percentage of the balance.

Banks pay interest in part to attract new savers and keep the ones they have. They want you to stick around and continue to bank with them.

Anyway, let’s say the interest rate on your account is a whopping 5 per cent annually. That would be a pretty nice sweetener to your savings, right?

Let’s also say you have $10,000 in your account.

So, you’re earning 5 per cent interest annually on your $10,000 principal, which means over the period of a year you would earn $500 in interest for a balance of $10,500.

This calculation is what we’d call simple interest.

With simple interest, you receive a one-off interest payment at the end of an agreed, set period of time, much like you would with a term deposit.

Compound interest, on the other hand, has a little more financial power.

Compound interest is interest earned on both the principal (your initial invested amount) and any interest you have earned.

So, let’s say you have that same $10,000 in an account.

In this case though, you’re earning 5 per cent interest annually but it is paid to you monthly on a pro rata basis. After the first month, you’ll have earned that $500 in annual interest, but because it is paid monthly on a pro rata basis, only $41.67 will hit your account.

But the next month, your interest will be calculated on the original $10,000 (the principal) as well as the $41.67 (interest). This means your balance is $10,041.67 and the 5 per cent interest will be calculated on this balance the next month.

This means you are earning interest on your interest!

It's why smarty pants Albert Einstein supposedly referred to compound interest as the eighth wonder of the world. Maybe. Wink.

But don’t take his word for it. See for yourself.

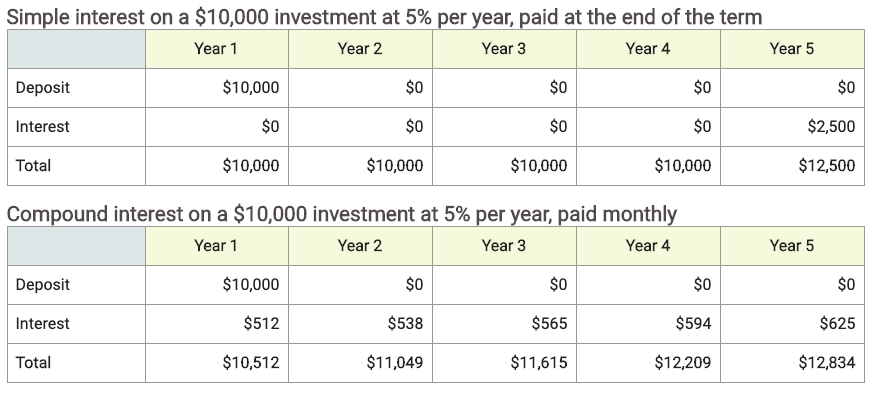

The following chart shows the meaningful difference between the benefits of compound vs simple interest.

We can see here that compound interest is a more impactful way to grow your savings, not to mention the benefits really grow over time. It’s a financial snowball that keeps on growing.

And it's one of the biggest drivers of long term investment growth.

By the way, your superannuation is a key beneficiary of compound interest. It's invested over a long time horizon and is continuously reinvested.

So, if you’re interested in using compound interest to help your savings grow, then the sooner you start, the better.