- Write down your goals, both simple and complex.

- Acknowledge what you spend.

- Separate daily spending from your pay.

- Give yourself a buffer.

- Aim for a 20% house deposit.

- Be honest and proactive. It's just money. Don't let it frighten you.

“I love it when a plan comes together” - John ‘Hannibal’ Smith, The A-Team.

If you have never heard of the A-Team, please watch the video below:

Hopefully what you gathered from that was that the A-team was the best.

If you had a problem that needing fixing, the A-Team were the ones to do it.

If you have a problem with saving money, well then consider Spaceship your very own A-team.

By the end of this blog, you’ll know how to save for that new car, new house or finally pay off all of that credit card debt.

What you need is a financial plan.

What is a financial plan?

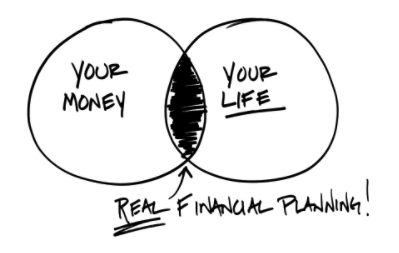

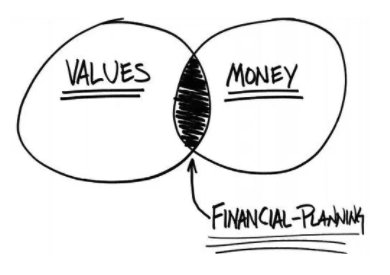

A financial plan is a comprehensive evaluation of your current and future financial state.

Or as the Certified Financial Planner Board puts it:

“The process of determining whether and how an individual can meet life goals through the proper management of financial resources."

Why is financial planning needed?

Unfortunately, people tend to spend more than they need to. The allure of short-term rewards is much harder to ignore than the future satisfaction of achieving a long-term financial goal.

For example; spending unnecessarily on a Friday night, when you are saving for a car.

Making a financial plan will substantially increase your chances of achieving that long-term financial goal. When saving money with more than one other person (couple/family) a financial plan is essential.

Without it, problems can arise and relationships can suffer.

What are Financial Goals?

Any goal with significant financial requirements (assets/income) is classed as a financial goal.

It’s important when setting your financial goals to set a time frame.

For example, do you want to buy a new car in six months time? Or two years time?

Not setting one can lead to a lack of motivation and decrease the likelihood of achieving your financial goal.

Your financial goals might include setting up an emergency fund, getting out of debt, buying a car, buying a house, starting a business, paying for a course or even a comfortable retirement.

Simple Goal - Emergency Fund

An example of a straightforward short-term goal is an emergency fund.

Let’s say you have a target of $5,000 and you want to save it in 12 months time.

You then break it down, to whatever level you prefer.

It’s approximately $417 a month, or $105 a week, or $14 a day.

Complicated Goal - House

For a more extensive expense, your financial plan may not be as straightforward.

For example if you want to save for a house this would be a method on how you could do so.

1. Review your spending for the last 6-12 months.

Go through your bank and credit card statements and look at where cuts can be made. Then draw up a workable budget broken down into essential and nonessential spending.

2. Set up a cash management system.

Have all of your income paid into an interest-bearing cash management account or loan offset account. From here pay yourself a regular amount each pay period into an ‘everyday account’. This separates your savings from your expenditure.

3. Have a float to cover fluctuations.

Your ‘everyday account’ should have a float of, say $1,000, so that you can manage the occasional fluctuation in expenditure.

4. Take out a set amount of cash each week.

Cash expenditure can be hard to track, so take only a set amount out each week and put all other spending on Eftpos or a credit card so they can be monitored. All Eftpos and credit card expenditure should also be paid out of the everyday account.

5. Continue to refine your budget and adjust your regular payment accordingly.

The control parameters are an essential part of proactively managing your savings and expenditure. If you allow too much flexibility, your savings can be eroded away.

6. Budget based on your pay cycle.

If you’re paid monthly, budget monthly.

7. Work out the loan repayments that you can commit to based on your budget.

As interest rates are low at the moment, it is essential to leave some room in your budget for interest rate increases. Banks will assess you based on an interest rate of 7.5 per cent to 8 per cent to allow for these interest rate rises.

8. Aim to have at least a 20% deposit.

When purchasing a home, you should try to have at least 20% deposit and enough to cover the extra costs such as stamp duty etc. If you have less than this amount, you would need to increase your borrowings to pay mortgage insurance over the whole loan, not just the amount over 80%.

As an example, if you wanted to purchase a property worth $500,000 the costs would be the following:

- Stamp duty on purchase = $17,990

- Purchase costs (legal fees etc.) = $2,010

- Purchase price = $500,000 ($520,000 with added costs)

- Less savings = $ 70,000

- Loan required (90 per cent) = $450,000

- The loan mortgage insurance would be approximately $7,920. This amount is capitalized onto the loan amount.

You will need to save $120,000 if you only want to borrow 80 per cent of the purchase price and not pay mortgage insurance.

9. Be proactive!

Set a budget, set a savings goal, and continually manage the budget.

Hopefully, you now know the method to save for your financial goals, whatever they may be.

If you are ever tempted by the short-term reward of an unnecessary purchase, just think of the satisfaction of achieving your financial goal, and being able to say: