Outline:

- Invest smaller parcels of money over time, rather than all at once;

- This protects against sharp market fluctuations;

- It builds good habits.

Dollar-cost averaging means committing to investing a set amount over a period of time.

That's as opposed to investing one lump sum.

As an investment strategy, it aims to reduce the impact of volatility on the purchase of financial assets (like stocks). It may also help to reduce ‘investor paralysis’.

Hypothetically, you want to invest $12,000 in the market; you have two choices:

- Invest everything today, or;

- Split it into equal portions and invest consistently over a set period of time

Option one is a lump-sum investment; option two is dollar-cost averaging.

If you choose option two, you may choose to invest $1,000 dollars a month over 12 months. So, you are averaging into the market by buying 12 times instead of one. This means you are getting the average price of the 12 times you buy.

Real world examples might be:

- A person inherits $100,000 and wants to create a portfolio. They can invest all at once or make smaller investments over time.

- A person is saving money to build a portfolio. They can either save all the money up in their bank account and make one investment at the end of the year or make regular small investments during the year.

Why do people dollar-cost average into the market?

Dollar cost averaging is a way to reduce market timing risk.

Basically, you protect yourself from being fully exposed if the market drops dramatically. By making regular investments of smaller amounts the investor has reduced one of the risks of investing. However, by reducing risk they may also risk reducing their return if the markets go up as they invest.

By buying a fixed amount on a regular schedule, your focus is on accumulating assets instead of timing the market. For those building their savings; making regular investments means your money is exposed to the market sooner than if you saved up a specific amount of money and invested it in the future.

The potential of short-term losses often makes us forget about long-term growth. The losses that may come tomorrow or next week can stop us from investing altogether.

Behavioural economists call this loss aversion. It’s the idea that people tend to prefer avoiding losses to equal gains. Simply, most of us prefer to keep $5 then make $5.

Amos Tversky and Daniel Kahneman’s study suggests that losses are twice as powerful as gains. This means most of us prefer to keep $5 then make $10.

By averaging into the market; you buy more when the price is low and less when the price is high.

Remember, for dollar-cost averaging to be effective, you must commit to your plan. If you stop investing when the market goes down and start again as prices go up, you aren’t dollar-cost averaging.

You are trying to time the market.

The math behind dollar-cost averaging

To calculate the average price per share, we use the harmonic mean.

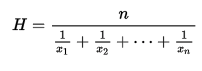

The formula looks like this:

It may look complicated but it’s simple. H is the average price you pay for a share, n is the number of times you buy and x1,* x2*, …, xn are the different share prices you pay.

Let’s walk through an example.

You have $300 and you want to invest it over three months by buying $100 of a company’s’ shares each month.

╔══════╦═════════════════╦══════════════════════════╗

║ Month║ Share Price ($) ║ Shares Bought ║

╠══════╬═════════════════╬══════════════════════════╣

║ 1 ║ 5 ║ 20 ║

║ 2 ║ 4 ║ 25 ║

║ 3 ║ 5.88 ║ 17 ║

╚══════╩═════════════════╩══════════════════════════╝

So, n = 3 (months), x1 is $5, x2 is $4 and x3 is $5.88.

H = 3 /(1/5 + 1/4 + 1/5.88) = ~$4.84

So, the average price you paid was ~$4.84 and you end up with 62 shares. If you invested the entire $300 in the first month, you would only have 60 shares.

Without dollar cost averaging the 60 shares are worth $352.80

With dollar cost averaging you now have 62 shares worth $364.56.

Risks of dollar-cost averaging

Experts argue dollar-cost averaging is simply a form of postponing market risk for no reason. By not investing part of your portfolio today, you delay the allocation of cash to your portfolio.

This means you risk missing out on rising prices; as the cash portion of your portfolio will not earn a return. Experts call this cash drag. Further, the cash you do not invest can lose purchasing power due to inflation.

Purchasing power is a fancy way of saying what you can buy with an amount of money; say $5. A few decades ago, a Coke would cost you one cent; today our smallest coin is 5 cents and it won’t buy you a Coke.

Another risk or disadvantage of dollar cost averaging is transaction costs. You may pay more in transaction costs to make multiple small investments.

An example of dollar-cost averaging

The best dollar-cost averaging strategies are automated.

You set it up once and forget about it. This helps you stick to your plan. An example is superannuation.

You are dollar-cost averaging into your Super investments. Under the SG ACT, employers must pay your Super each quarter at a minimum.

So you are buying financial assets at least four times a year and pay the average price of the four times you buy.

Automating dollar-cost strategies are fairly simple though, and there are funds available to provide access to all kinds of different markets.

Conclusion

History shows investing as a great way to build wealth. The S&P 500 grew an average of 7% from 1950–2009.

Investing can be daunting — losing money is a possibility and humans are loss averse.

If dollar-cost averaging reduces short-term losses, it may help you start investing.

Most of us can’t time the market and there is no guarantee that we will act rationally. Nor will dollar-cost averaging guarantee profits; no investment strategy will.

If you have a low-risk appetite and want to diversify the price you pay for financial assets–by purchasing more when the prices are low, and less when the prices are high–then look at automated dollar-cost averaging services.

It is your choice.

As Benjamin Graham, the father of value investing, said:

“[Dollar cost averaging] has worked extremely well for those who have had a) the money, b) the time and, c) the character necessary to pursue a consistent policy over the years regardless of whether the market has been going up or down. If you can do that, you are guaranteed satisfactory results in your investments.”