Bitcoin has taken the world by storm, but it can be intimidating to people who are interested in investing in it. Enter Bitcoin Exchange-Traded Funds (ETFs); a bridge between the new world of cryptocurrency, and the more familiar territory of traditional stock markets.

In January 2024, the US Securities and Exchange Commission (SEC) approved the first-ever batch of spot bitcoin ETFs. In the following days, major financial firms — such as BlackRock and Ark Investments — released new bitcoin products on US-listed exchanges.

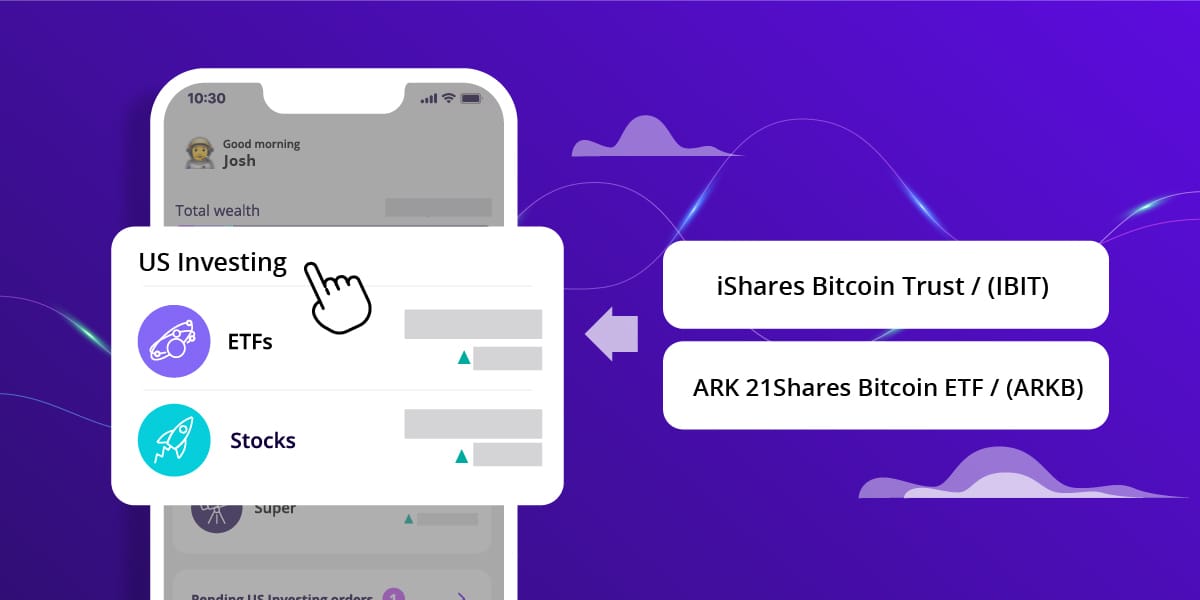

Through the Spaceship US Investing Service, customers are now able to access the iShares Bitcoin Trust ETF, which is listed as IBIT on the Nasdaq, and the ARK 21Shares Bitcoin ETF, which is listed as ARKB on the Cboe BZX exchange. We’ll also consider adding more bitcoin ETFs to the service as they fulfil our US Investing criteria, including having a large enough market cap and not short-selling or being leveraged.

But before you dive into the world of crypto, it’s important to know exactly what asset you may be thinking of investing in, as well as the risks and benefits associated with it.

What is a bitcoin ETF?

An ETF is an investment fund that you can buy and sell on a stock exchange. Investment Funds can hold assets such as stocks, bonds, commodities, or other assets.

Bitcoin ETFs are investment funds that hold bitcoin. Generally speaking, this means the value of the fund (and the price of the ETF) tracks the value of bitcoin.

As certain bitcoin ETFs have been approved by the SEC, they can now be traded through US-listed stock exchanges, just like more traditional ETFs and stocks. However, it's important to remember that the SEC does not endorse bitcoin, as it’s considered a very risky alternative asset.

How do bitcoin ETFs work?

Just like regular ETFs, bitcoin ETFs are traded on traditional stock exchanges, and their value is generally expected to rise when the value of bitcoin increases in price, or fall if bitcoin decreases in price.

Bitcoin ETFs are a way for investors to get exposure to the value of bitcoin without directly owning it.

What kinds of bitcoin ETFs are there?

There are two main types of bitcoin ETFs:

- Spot ETFs: These funds own actual bitcoin, and their price is directly correlated to the current market price of bitcoin.

- Futures ETFs: These funds don't hold bitcoin directly, as this was not previously permitted by the SEC. Instead, they hold futures contracts, which promise to buy or sell bitcoin at a later date. This allows them to replicate similar outcomes to holding bitcoin directly.

What are the benefits of investing in bitcoin ETFs?

There are many benefits to investing in bitcoin ETFs over directly owning bitcoin, including:

- Accessibility: You can buy and sell bitcoin ETFs through brokerages or stock exchanges that you’re already familiar with, which demystifies the process of actually making trades

- Decreased personal responsibility: Through investing in bitcoin ETFs, you can benefit from the growth of bitcoin, without needing the responsibility of owning your own crypto wallet and keeping your key information safe. Major financial firms that are sponsoring these ETFs typically take more measures to protect these assets — such as using encryption and security software — than the average investor might.

- Regulation: ETFs are subject to stricter regulations than direct crypto purchases, because they're listed on stock markets which have requirements for listing. This can give you peace of mind that you’re investing in a compliant product.

- Diversification: Having bitcoin ETFs as part of a broader portfolio with different asset classes is one way to get exposure to bitcoin without putting all your eggs in one basket. If you buy bitcoin ETFs through the same platform or brokerage that you buy other investments, you’ll also benefit from seeing your holdings in the same place.

- Tax efficiency: One of the difficulties in owning bitcoin directly is that its decentralised and unregulated, which can be difficult to account for at tax time. Bitcoin ETFs make tax reporting much easier because they are listed investments.

What are the risks of investing in bitcoin ETFs?

Like every investment product, there are certain risks and costs associated with bitcoin ETF that you should be aware of before you invest. They include:

- Volatility: All cryptocurrencies, including bitcoin, are extremely risky and volatile. It is important to understand that this volatility could lead to significant financial loss. While the ETF structure can mitigate some of the complexities associated with crypto, it doesn’t protect you against the inherent risks of the cryptocurrency market.

- Management fees: While investing in spot bitcoin ETFs could save you the time and costs of exchanging and securing bitcoins yourself, these ETFs do charge management fees. These fees are often higher than those of traditional equity ETFs, as the fund incurs costs for securing bitcoins.

- Tracking error: While spot bitcoin ETFs try to mirror the performance of bitcoin closely, tracking errors can occur. Reasons for this might include liquidity in the market, delayed rebalancing of the fund’s holdings, and the impact of management fees.

- Regulatory uncertainty: Another risk involves the lack of a clear regulatory framework to protect investors. As it is still the early days of crypto, both domestic and international regulations around crypto markets are still evolving — which means future regulations could affect the performance of bitcoin ETFs.

- Security risks: Large bitcoin funds may be targets of cybercriminals. While ETF managers typically employ more security measures than direct investors, no system is impenetrable. And stolen bitcoins can quickly be transferred anonymously and are almost impossible to retrieve.

- Psychological impact: Due to the volatile nature of bitcoin, as well as the possibility that bitcoin can be stolen and never recovered, investing in bitcoin ETFs could cause psychological stress to unit owners.

Before you invest in spot bitcoin ETFs, be sure you do your research and understand the asset you’re investing in, to ensure that the asset aligns with your personal investing goals and risk profile. Also, consider how much you’re willing to (and able to) invest in bitcoin spot ETFs, the percentage of your portfolio you’re willing to devote to it, and how frequently you intend to make investments.

Remember, it’s always a good idea to seek professional financial advice before investing.

Important! We’re sharing with you our thoughts on the companies available through our US Investing service for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.