Have you ever felt paralysed by the enormity of your possibilities?

You’ve been given an education, the capacity to smile and a bit of get-go, but exactly what you’d like to do with your time on earth is making it hard to focus and find a direction.

When your values are clear to you, making decisions becomes easier.

The link between our values and how we allocate our resources (our money, our time, our smile) is important. One directly affects the other!

In order to understand the ways in which we’d like to design our lives, we need to interrogate and understand what we value. So rather than sit passively on the internet, let’s do an exercise.

For this post, let’s define ‘value’ as one’s judgement of what is important.

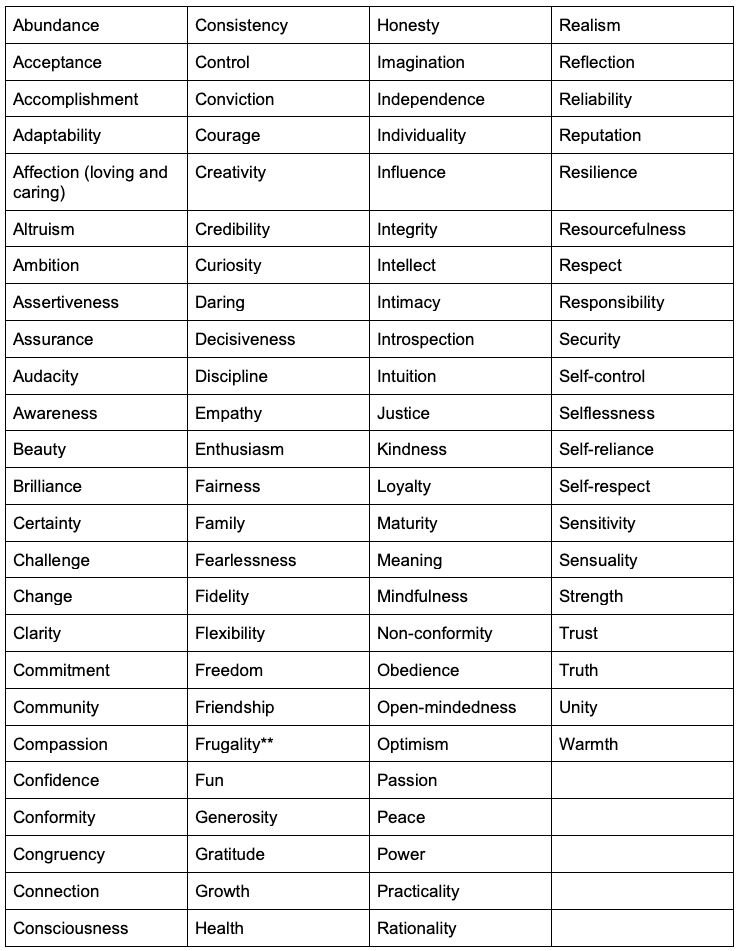

Below is a list of 100 personal values. Some of completely stand-alone values, while others are derivatives or variations of other values.

** I’m going to fill out the questionnaire for one of my values, so you can see how someone else thinks about it.**

Step 1. Read through the list and note the values that resonate with you.

Note: It helps to read the list first and then begin note. That said, you can note as many as you like.

You might have three, or five, or ten or twenty of these values.

I’ve chosen frugality.

But now we’re going to have a look at how these values came about.

Step 2. When and how was I taught the importance of this value?

This might be a direct lesson or something you picked up from watching other people behave.

Frugality. My folks never had a great deal of money when I was growing up in Brisbane. My Dad was a carpenter and my Mum was a stay at home mum. They started their own business when I was about 14, but before that, I remember money was really tight.

They were great about never letting money loom large in our lives, but both Mum and Dad were frugal people. Dad taught himself to fix almost everything that went wrong around the house. I remember him inventing a crazy drainage system when a huge storm burst our roof.

Mum was also really resourceful in the kitchen, I think her grocery budget was about $25 a week for a really long time and, because toys were expensive, she was thrifty at setting up games my brother and I could play with stuff around the house.

I saw them make conscious choices our whole life and it’s something I really value now.

Step 3. Do I embody this value in my life now?

Does this value translate into actions and behaviours? If it doesn’t appear in your life, why not?

I’ve become more frugal as I’ve got older. (I’m 28 now.) But because I don’t have any kids or even a mortgage, I don’t have to make many hard choices when I get paid from my life.

I’d like to be more frugal, I really respect people who are. But I know that going out for dinner and buying clothes (even though they’re mostly second hand!) are some of my favourite things to do and they cost money…

I also have a habit of snapping up the opportunity to go overseas whenever it arises!

Is it an internal force that keeps it hidden, or is an external force?

I think external forces keep frugality hidden in my life. Because I am paid well and don’t have to think about anyone else, it’s not a necessity. But I’d like to think if I was trying to make do on much less money per week, I’d be able to adjust my behaviour and come up with creative ways to save money.

Step 4. Is this value really mine?

We often think we should be doing a lot of things!

Is this value something you think you should embody? If yes, it could be a belief you have rather than a deeply held value.

Maybe think about where it came from.

Yes, I do think it’s a value of mine. It’s definitely come from my parents, but I think it’s something more personal than a guilty feeling.

Step 5. Make your values real. What’s your ideal self?

Imagine an ideal version of yourself 10 years in the future. What does your life look like?

Select five of your most important values for this step.

And now get creative and detailed. Describe your family life, your career, what you do in your spare time, your hobbies and what goals you still might have. Doing this can really help you clarify which values are the most important to your future goals and aspirations.

Frugality.

I’d like to live in a beautiful place where I can run my own schedule. I hope to have a loving, curious family where I have the luxury of spending as much time as I can with them while also travelling around the world for my job. I hope to have found a balance between having lovely things, but not overrun with them, and I hope to be known to be resourceful and carefree.

Step 6. Translating values to activities.

What can you do, in the life you’re living now, to embody and act out your values?

I can start by tightening my budget. If I have less money in my day to day spending account, I will likely begin thinking of resourceful ways to use the things I already have.