It’s been a tough start to the year, so for our latest quarterly update, our senior portfolio manager, Jason Sedawie, has written an update for Spaceship customers on what’s going on.

Take it away, Jason…

Ouch.

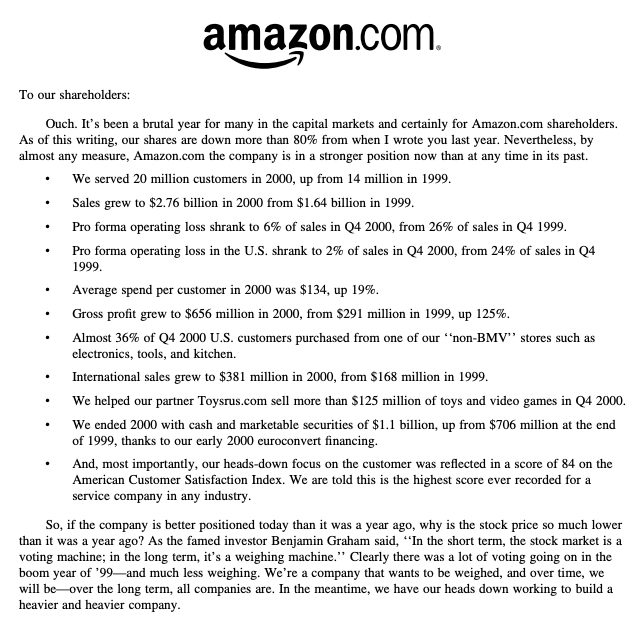

It’s been a brutal year for many in the capital markets and certainly for Amazon.com shareholders Amazon.com shareholders Spaceship Voyager unitholders. Yes, we did just borrow a line from Amazon.com's 2000 shareholder letter – see Jeff Bezos’ post-dot com letter below.

We’re sharing Amazon’s letter as a reminder that while the current market correction we’re seeing isn’t a new phenomenon, if it's the first time you have experienced a correction, it might feel very new to you.

Severe corrections occur every couple of years and can cause share prices to unlink themselves from business fundamentals like Amazon above.

Once again Amazon shares are suffering through a correction, down by almost 36% (as at 15 July 2022) over the last year. If you find Amazon’s Prime day sales and discounts exciting, you should be able to get excited about the current market correction and Amazon’s discounted share price.

Like Jeff, we’re weighing up underlying company business fundamentals such as sales, customer growth, and cash flow, over short term share price volatility for our actively managed Where the World is Going (WWG) Spaceship Universe and Spaceship Earth portfolios.

From an investment perspective, there is current weakness in advertising and e-commerce but generally the business fundamentals for the portfolios are mostly performing to expectations.

(For the Spaceship Origin Portfolio, it’s a little different. It is a rules based portfolio made up of around 100 of some of the largest ASX listed companies by market capitalisation, and around 100 of some of the largest global companies by market capitalisation. Its composition tends to be more reflective of the broader market.)

Investing through market volatility

Volatility has increased due to inflation, higher interest rates and Russia’s invasion of Ukraine with business fundamentals taking a back seat to the macro environment.

Tuning out this market volatility is easy to say but hard to do. Share prices can move anywhere in the short term, but over the long term prices should reflect business fundamentals.

Speaking of hard, it has been a tough period for the Spaceship Voyager portfolios. Recent performance has been poor. We understand the pressure this puts on investors. Uncertainty and volatility can create feelings of fear and a desire to exit. Yet to optimise long term returns, we have to deal with short term pain as stock market volatility is a feature not a bug.

Our Spaceship Universe Portfolio and Spaceship Earth Portfolio (the WWG portfolios) have been affected by a Covid-19 overhang as investors reassess what growth is sustainable in a post-Covid world.

For example e-commerce shares performed well during Covid when demand for their services was pulled forward due to lockdowns. These same companies are now suffering as demand has dropped off and ongoing growth is reassessed. Nevertheless, our conviction in these companies remains strong as the US e-commerce market share of 13% is still low compared to other countries (such as the UK, which has a 29% market share), supporting our view that growth will continue.

In the last two years we have seen two market extremes. During Covid-19, markets were forward looking as lockdowns and hybrid work increased technology adoption, while war and inflation concerns have increased the focus back to today’s immediate problems such as inflation. The true long term growth trends are likely to fall somewhere in between these two extremes as we believe hybrid work is here to stay.

It shouldn’t surprise that we continue to invest Where the World is Going (WWG). Our WWG investment approach continues its focus on future trends and habits, leading to a bias towards investing in growth stocks and future trends such as electric vehicles and digital payments, rather than investing based on current problems.

It means investing in trends 3-5 years ahead and not reacting to what has just happened, as the short term environment can change quickly e.g. the shift from COVID-19 to inflation and now to slowing growth and recession concerns. It’s counterintuitive but a slower economy could be better for growth companies and a growth investment style. A slower economy means lower interest rates and less economic growth with investors more willing to invest in companies that can produce sustainable growth.

Our WWG process results in a portfolio that is different to general indices; it's generally overweight in technology shares, communications, consumer discretionary, and healthcare, at the expense of banks, resources and energy which currently has been a source of underperformance versus broader benchmarks.

The impact of inflation and why the WWG portfolios are well positioned

Though we are forward looking, it’s important to discuss inflation's impact on the WWG portfolios.

The rising inflationary environment and interest rate hikes have not been good for growth assets as future profits are discounted back at higher rates, leading to lower valuations, and causing the Spaceship Universe and Spaceship Earth portfolios to underperform.

We believe this valuation impact has mostly been reflected in the performance of the WWG portfolios, but inflation has second order impacts for which the WWG portfolios are better positioned.

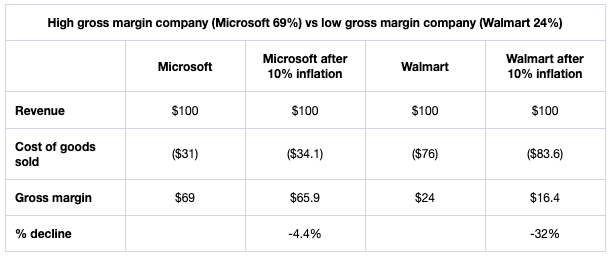

The average underlying company in both the WWG portfolios has a higher gross margin than the market (MSCI ACWI) which means they can more easily manage rising costs.

In particular, technology stocks tend to have high gross margins and little incremental product costs, so are better able to cope with inflation and rising costs. For example, Microsoft below has a 69% gross margin, costs of goods are 31%, so a cost increase of 10% will reduce gross margins to 66%, a much more manageable decline than a company with low gross margins like Walmart.

This ability to weather increasing costs is backed up by the WWG portfolios' energy efficiency. A way to measure the energy efficiency of a company is by understanding Greenhouse Gas Emissions compared to sales.

According to Bloomberg, the total Greenhouse Gas Emissions intensity per sale for the Spaceship Universe Portfolio is 23.5, while for the Spaceship Earth Portfolio it is 15.9 and for the Spaceship Origin Portfolio it is 133. (The Spaceship Origin Portfolio’s efficiency is comparable to general benchmarks like MSCI ACWI.) Meaning that both the Spaceship Universe and Spaceship Earth portfolios are more energy efficient and likely to be less impacted by rising energy prices.

We also expect technology spend to be relatively stable as one of the best ways to increase productivity and supply chain visibility in an inflationary environment is to use technology to gain efficiencies i.e. the ability to do more with less. Additionally, the companies that the Spaceship Universe and Spaceship Earth portfolios invest in have less debt/leverage than the market, so are less affected by rising interest rates.

To sum up, while the initial inflation scare has negatively affected growth stock valuations, we believe inflation’s secondary impact on costs and debt combined with companies' continued investment in technology to improve efficiency will leave us better positioned than the general market with higher than average growth, gross margins and lower leverage.

Predicting the future?

We don’t know when shares will recover but so far the fundamentals for businesses investing in technology appear to be intact.

The GFC provides a pathway: we’re not saying this timeframe will repeat because every situation is different but we do know companies with the best fundamentals will recover faster.

In 2007/2008 the companies with the best fundamentals such as Apple and Amazon took two years to recover to all time highs. Alternatively, structurally impaired companies such as eBay took nearly five years to recover.

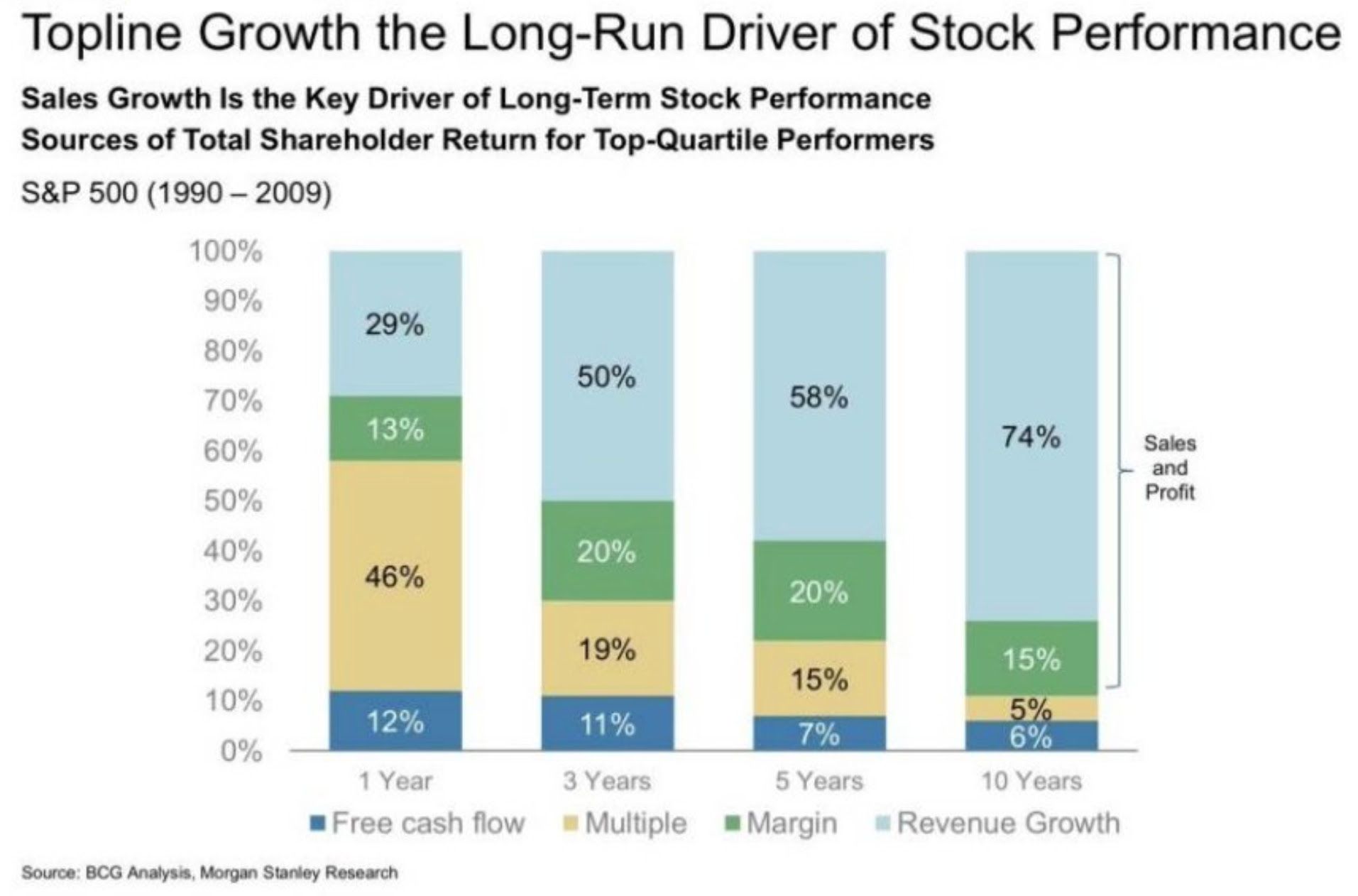

Stock prices can divorce themselves from business fundamentals in the short term but over time these fundamentals will be reflected in prices. The analysis below from Morgan Stanley demonstrates that in the short run, multiples (i.e. valuations or price earning multiples) drive stock performance, accounting for 46% of stock price movements. However, over the longer term, business fundamentals such as revenue growth (i.e. sales and profit growth) trump short-term multiple volatility, accounting for 74% of a stock’s performance over ten years.

We remain disciplined in investing in Where the World is Going, focusing on companies becoming more relevant to customers rather than focusing on the problems of today. In times like these investing can be painful but we get to choose whether we feel the short term pain of discipline or long term pain of regret; staying disciplined sticking to a well thought out process such as dollar cost averaging even when markets are falling and volatile, or in a falling market, selling out and feeling good short term but regretting it later due to missed investment opportunities when the market eventually recovers.

The pain of regret is a long term cost while the pain of discipline is short term. It’s easy to look back at past corrections and see what a great buying opportunity it was, but at the time investing felt horrible. Right now, macroeconomic news is trumping individual business developments but it's creating many mis-priced opportunities.

Remember this too will pass for long term investors. Thank you again for investing in Where the World is Going for the long term.

One or more of the Spaceship Voyager portfolios invest in Amazon, Apple, Microsoft, and Walmart.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.